Selecting the right payroll software for your business can be a daunting task. A range of factors such as features, scalability, and pricing need to be considered.

In this article, we review the top 23 best payroll software packages available in the UK, focusing on their features, pros, cons, and pricing.

Best payroll software UK

| Software | Pricing | Pros | Cons |

|---|---|---|---|

| 12 Cloud | Starting from £50/month | Highly scalable, Multi-country support, Robust security features, Integrated analytics tools | Complex interface, Expensive for small businesses, Limited customer support, Requires training |

| 12Pay | Free for up to 9 employees | Free entry-level means low cost of entry for very small businesses | No electronic payslips for free version, extra cost for some modules |

| ADP | Quote-based | User-friendly, Extensive add-ons, Robust customer service, Good mobile accessibility | Pricey for advanced features, Not for very small businesses, Limited customisation, Time-consuming setup |

| BrightPay | Starts at £199/year | Auto-enrolment for pensions, Good customer support, Simple interface, Low annual cost | Limited reporting, Desktop-based, Limited third-party integration, Infrequent updates |

| Cintra | Quote-based | Fully HMRC-compliant, Bespoke solutions, High data security, Public sector specialisation | Limited for SMEs, High set-up cost, Complex interface, Slower customer service |

| FreeAgent | Starts at £14/month | Simple interface, Affordable, Direct filing with HMRC, Supports multiple users | Limited advanced features, No multi-currency, Lacks in-depth analytics, Limited phone support |

| IRIS | Starting from £10/month | Extensive reporting, HR tools integration, Regular updates, Supports various business sizes | Expensive for small businesses, Limited mobile support, Requires training, Customer service could improve |

| MHR | Quote-based | Comprehensive HR suite, Advanced analytics, Highly customisable, Scalable for growth | Complex interface, High upfront costs, Limited online support, Requires training |

| MoneySoft | Starts at £120/year | Affordable, Simple functionality, Quick setup, No-frills interface | Limited add-on features, No mobile app, Limited customisation, Basic reporting |

| Moorepay | £50/year (estimated) | An industry leader, widely used with good reviews | Hidden pricing, lack of transparency on fees |

| Onfolk | Starts at £20/month | Easy to use, Cloud-based, Quick setup, Automated updates | Limited customisation, No advanced analytics, Limited third-party integration, Basic customer support |

| Orbital | Quote-based | Complex pay structures, Scalable, High data security, Advanced analytics | High costs, Not for SMEs, Limited customer service, Requires extensive training |

| PayEscape | £53/month base fee, plus £3.20/month per employee | Dedicated customer support, easy workflow and usability | No free trial, additional charges may apply |

| Payfit | Starts at £39/month | User-friendly, Customisable, Mobile app, Quick implementation | Limited third-party integration, Expensive for small businesses, Limited reporting, No multi-country support |

| QuickBooks | Starts at £8/month | Integration with accounting, User-friendly, Multiple payment options, Good mobile app | Limited advanced features, Costs can add up, Limited customisation, Lacks robust analytics |

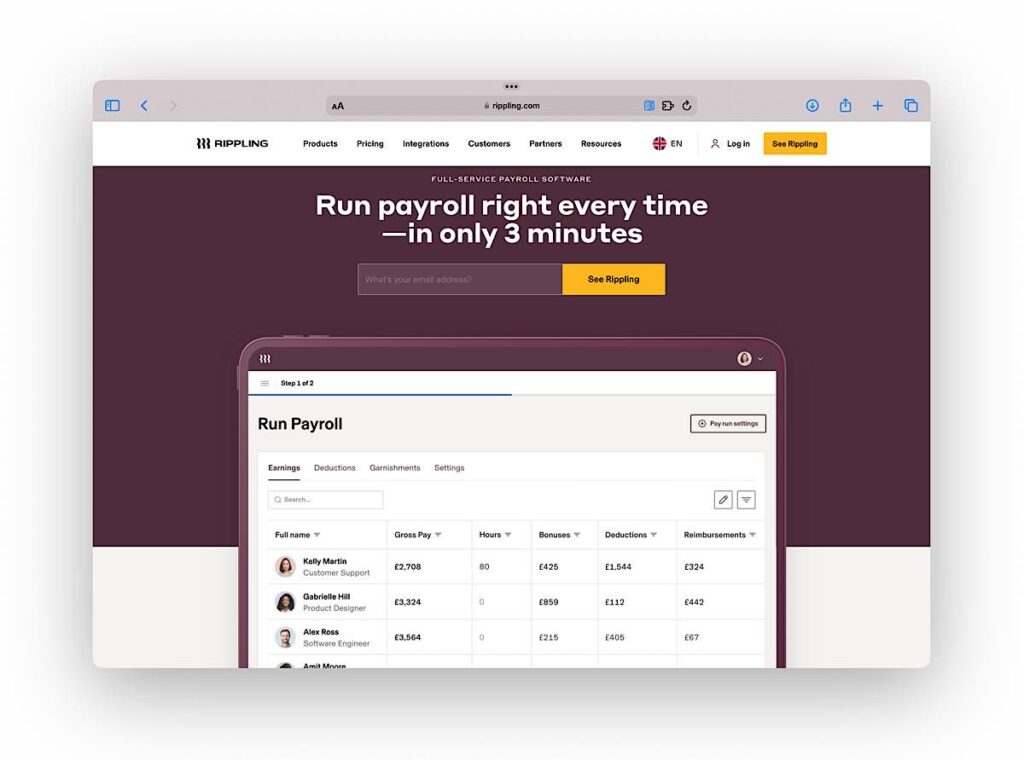

| Rippling | Starts at £7 per user per month | Good user experience, modern software, supports international employees | Customisation adds to price, as does integration with other software |

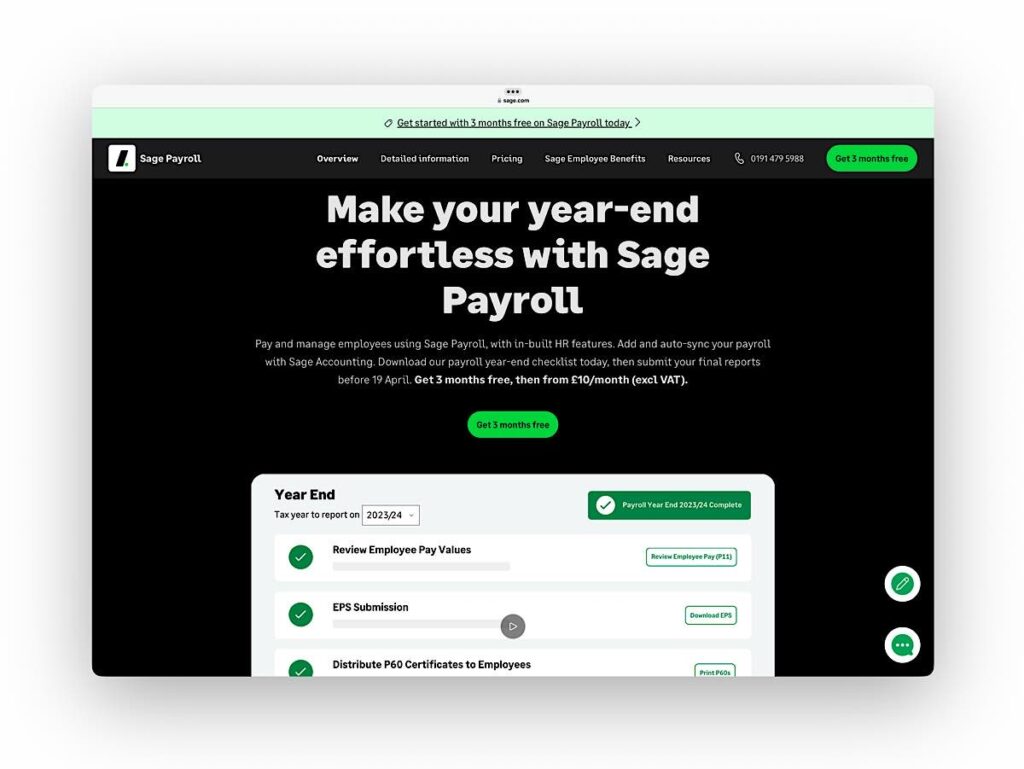

| Sage | Starting from £12.50/month | Reliable brand, Comprehensive features, Good customer support, Highly scalable | Can be expensive, Dated interface, Limited mobile capabilities, Complexity requires training |

| SD Worx | Starting from £10 per employee per month | Widely used and popular option, also offers international payroll | Lack of transparency on pricing, additional fees can add up |

| Shape | Starts at £35/month | AI-driven analytics, Modern interface, Customisable dashboard, High data security | Limited customer reviews, Expensive for small businesses, Limited third-party integration, Advanced features require training |

| ShiftAI | Starts at £2/month | Streamlines payroll and HR tasks with automated features, HMRC compliance, and scalable plans, robust support and integration capabilities | Learning curve, limits advanced features to higher-tier plans, offers full functionality mainly to iOS users |

| Xero | Starts at £11/month | Strong mobile features, Good accounting integration, User-friendly, Regular updates | Limited customisation, Costs can add up, Lacks advanced analytics, Limited phone support |

| Zalaris | Starts at around £100 per month (estimated) | Powerful HR features, suited to larger organisations | Complexity can be overwhelming, adding features can increase costs significantly |

| Zellis | From £50/month, but with many other costly modules available | Wide range of available features from simple payroll to advanced HR tools (at additional cost) | Can be expensive and unnecessarily feature-packed for small businesses |

12 Cloud

12 Cloud is tailored for large enterprises, offering advanced features and high scalability. It comes with robust security measures and integrated analytics tools, making it a comprehensive solution for multinational organisations.

Best suited for:

Large enterprises looking for a scalable solution with multi-country support.

- Takes 2 minutes

- Receive quotes to compare

- Easy and no commitment

Pricing:

Starting from £50 per month

Pros:

- Highly scalable

- Multi-country support

- Robust security features

- Integrated analytics tools

Cons:

- Complex interface

- Expensive for small businesses

- Limited customer support

- Requires training to maximise utility

Further information:

Read our 12 Cloud Payroll review or visit the website.

12Pay

12Pay‘s payroll solutions are certified by HMRC and offer a suite of functionalities, including compliance with tax and NI legislation, direct RTI submissions, multiple payslip printing methods, and optional pension auto-enrolment.

Best suited for:

12Pay is well-suited for a diverse range of UK companies, from fledgeling enterprises in need of basic payroll management to expansive organisations requiring robust payroll processing capabilities.

- Give your requirements

- Receive quotes to compare

- Choose a provider or walk away - your choice!

Pricing:

With no charge for the Express service, 12Pay ensures affordability, while the Premium and Bureau services are available at annual fees of £79+VAT and £156+VAT, respectively, plus additional charges for supplementary features.

Pros:

- Complimentary version for startups

- Seamless transition to more advanced packages

- Extensive capabilities with Premium and Bureau options

- Bureau version caters to an unlimited number of employees and companies

Cons:

- Express package has limited functionality

- Extra charges for pension and CIS features

- Lack of electronic payslip distribution in the free package

Further information:

Read our 12Pay payroll review or visit the website.

ADP

ADP stands out for its user-friendly interface and extensive add-ons. Ideal for businesses seeking more than just payroll services, it also offers time and attendance tracking amongst other features.

Best suited for:

Medium to large businesses looking for extensive HR and payroll functionalities with a focus on mobile accessibility.

Pricing:

Quote-based

Pros:

- User-friendly interface

- Extensive add-ons like time and attendance tracking

- Robust customer service

- Good mobile accessibility

Cons:

- Pricy for advanced features

- Not ideal for very small businesses

- Limited customisation options

- Setup can be time-consuming

Further information:

Read our ADP payroll review or visit the website.

BrightPay

UK-based BrightPay is designed for small and medium-sized enterprises. It offers auto-enrolment for pensions and a straightforward, user-friendly interface at a reasonable annual cost.

Best suited for:

Small and medium-sized businesses, especially those in need of simple pension auto-enrolment features.

Pricing:

Starts at £199 per year

Pros:

- Auto-enrolment for pensions

- Good customer support

- Simple, user-friendly interface

- Low annual cost

Cons:

- Limited reporting capabilities

- Desktop-based; lacks a mobile application

- Limited third-party integrations

- Updates can be infrequent

Further information:

Read our BrightPay review or visit the website.

Cintra

Cintra focuses on bespoke payroll solutions for large enterprises and public sector organisations. With a range of advanced features, it’s tailored for complex payroll requirements, especially for organisations that need to be HMRC compliant.

Best suited for:

Large enterprises and public sector organisations with complex payroll needs.

Pricing:

Quote-based

Pros:

- Fully HMRC-compliant

- Bespoke solutions

- High data security

- Specialised for public sectors

Cons:

- Limited suitability for SMEs

- High initial set-up cost

- Complex user interface

- Slower customer service response times

Further information:

Read our Cintra payroll review or visit the website.

FreeAgent

FreeAgent is an affordable and simple solution for freelancers and very small businesses. It allows direct filing with HMRC and supports multiple users, making it a straightforward option for basic payroll needs.

Best suited for:

Freelancers and micro-businesses who want an affordable, simple solution with direct HMRC filing.

Pricing:

Starts at £14 per month

Pros:

- Simple, intuitive interface

- Affordable pricing

- Direct filing with HMRC

- Supports multiple users

Cons:

- Limited advanced features

- No multi-currency support

- Lacks an in-depth analytics dashboard

- Limited phone support

Further information:

Read our FreeAgent payroll review or visit the website.

IRIS

IRIS caters to a wide range of business sizes but is particularly useful for medium to large organisations. It offers extensive reporting capabilities and the potential for integration with other HR tools.

Best suited for:

Medium to large businesses that require extensive reporting and HR integration.

Pricing:

Starting from £10 per month

Pros:

- Extensive reporting capabilities

- Integration with other HR tools

- Regular software updates

- Supports a wide range of business sizes

Cons:

- Expensive for small businesses

- Limited mobile support

- Requires training to utilise fully

- Customer service could be improved

Further information:

Read our IRIS payroll review or visit the website.

MHR

MHR provides a robust suite of HR services alongside its payroll offerings. Its advanced analytics dashboard and high customisability make it a complete package for businesses planning for growth.

Best suited for:

Businesses looking for a comprehensive HR and payroll package with room for scalability.

Pricing:

Quote-based

Pros:

- Comprehensive HR suite

- Advanced analytics dashboard

- Highly customisable

- Scalable for growth

Cons:

- Complex interface

- High upfront costs

- Limited online support resources

- May require in-house training

Further information:

Read our MHR payroll review or visit the website.

MoneySoft

MoneySoft offers a simple, no-frills approach to payroll, ideal for SMEs who just want to get the job done. The software is focused on basic, essential functions without complicating the user interface.

Best suited for:

Small and medium-sized businesses seeking an affordable, straightforward payroll solution.

Pricing:

Starts at £120 per year

Pros:

- Affordable annual pricing

- Simple, focused functionality

- Quick setup

- No-frills interface

Cons:

- Limited add-on features

- No mobile application

- Limited customisation options

- Basic reporting features

Further information:

Read our MoneySoft payroll review or visit the website.

Moorepay

Moorepay is a leading UK provider of payroll and HR solutions, offering scalable software and outsourced services tailored to meet the needs of businesses of all sizes, ensuring compliance and efficiency.

Best suited for:

Small to medium-sized enterprises (SMEs) looking for scalable, comprehensive payroll and HR solutions, as well as larger organisations seeking efficient outsourcing services to ensure compliance and streamline operations.

Pricing:

Starts at £50 per year (estimated)

Pros:

- Scalable solutions for businesses of all sizes

- Ensures compliance with UK payroll regulations

- Offers both software and outsourced services

- Regular software updates included

- Comprehensive HR integration options

Cons:

- Initial set-up can be costly

- Outsourcing may be expensive for large companies

- Additional services increase overall cost

- No free trial for software

- Integration costs can be high

Further information:

Read our Moorepay review or visit the website.

Onfolk

Onfolk is a cloud-based solution perfect for businesses that prefer an automated approach to payroll. With a quick setup process and automated updates, it offers an easy-to-use experience.

Best suited for:

Businesses seeking a straightforward, cloud-based payroll solution with automation features.

Pricing:

Starts at £20 per month

Pros:

- Easy-to-use interface

- Cloud-based

- Quick setup

- Automated updates

Cons:

- Limited customisation options

- No advanced analytics

- Limited third-party integrations

- Basic customer support

Further information:

Read our Onfolk review or visit the website.

Orbital

Orbital offers a solution for enterprises that have complex payroll structures. Its scalable design and high data security measures make it ideal for large organisations.

Best suited for:

Large enterprises with complex payroll structures and a need for high data security.

Pricing:

Quote-based

Pros:

- Handles complex pay structures

- Scalable for large businesses

- High data security

- Advanced analytics tools

Cons:

- High upfront and monthly costs

- Not suitable for SMEs

- Limited customer service support

- Requires extensive training

Further information:

Read our Orbital Payroll review or visit the website.

PayEscape

PayEscape is a UK-based payroll services provider offering flexible weekly and monthly pricing plans tailored to businesses of all sizes, ensuring efficient and compliant payroll management with dedicated support.

Best suited for:

Small to medium-sized businesses seeking cost-effective, scalable payroll solutions with the flexibility of weekly or monthly processing to match workforce dynamics.

Pricing:

£53 per month base fee, plus £3.20 per employee per month

Pros:

- Flexible weekly and monthly pricing plans

- Cost-effective for varying employee counts

- Dedicated customer support

- Scalable for businesses of all sizes

- Streamlines payroll management efficiently

Cons:

- Additional charges may apply for extra services

- No free trial mentioned

- VAT not included in listed prices

- Limited information on integration with other software

- Setup process details unclear

Further information:

Read our PayEscape review or visit the website.

Payfit

Payfit offers a user-friendly and highly customisable interface. The software is quick to implement and comes with a mobile app for convenient on-the-go payroll management.

Best suited for:

Businesses that want a highly customisable, user-friendly software with mobile app support.

Pricing:

Starts at £39 per month

Pros:

- User-friendly interface

- Highly customisable

- Mobile app for on-the-go management

- Quick implementation process

Cons:

- Limited third-party integrations

- Expensive for small businesses

- Limited advanced reporting

- No multi-country support

Further information:

Read our Payfit review or visit the website.

QuickBooks

QuickBooks offers seamless integration with its accounting software, making it a two-in-one solution for small businesses. Its user-friendly design and multiple payment options provide an easy payroll process.

Best suited for:

Small businesses already using QuickBooks for accounting and seeking an integrated payroll solution.

Pricing:

Starts at £8 per month

Pros:

- Seamless integration with accounting

- User-friendly interface

- Multiple payment options

- Good mobile application

Cons:

- Limited advanced payroll features

- Monthly costs can add up with add-ons

- Limited customisation options

- Lacks robust analytics features

Further information:

Read our QuickBooks payroll review or visit the website.

Rippling

Rippling is an integrated cloud-based platform offering comprehensive solutions for payroll, HR, finance, and IT, streamlining operations with automated processes, compliance management, and customizable features for businesses of all sizes.

Best suited for:

Small to medium-sized businesses looking for a scalable, all-in-one solution to manage payroll, HR, finance, and IT, aiming to streamline operations and ensure compliance efficiently.

Pricing:

Starts at £7 per user per month

Pros:

- Unified platform for HR, payroll, finance, and IT

- Automated compliance and tax filings

- Customisable features and integrations

- Scalable for businesses of all sizes

- User-friendly interface

Cons:

- Starting cost may be high for small businesses

- Customisations can increase price

- Integration costs for third-party software

- Complexity might overwhelm new users

- Potential for additional fees for advanced features

Further information:

Read our Rippling review or visit the website.

Sage

Sage is a tried-and-true solution offering a comprehensive set of features. Known for its reliability, it is suitable for businesses of all sizes and offers good customer support.

Best suited for:

Businesses of all sizes looking for a reliable, comprehensive payroll and accounting solution.

Pricing:

Starting from £12.50 per month

Pros:

- Reliable and reputable brand

- Comprehensive feature set

- Good customer support

- Highly scalable

Cons:

- Can be expensive with add-ons

- Dated user interface

- Limited mobile capabilities

- Complexity requires training

Further information:

Read our Sage payroll review or visit the website.

SD Worx

SD Worx delivers comprehensive, scalable payroll and HR solutions. Known for reliability, innovation, and customer-centric support, it offers SaaS, managed services, and integrated HR systems for businesses seeking efficient workforce management.

Best suited for:

Businesses of all sizes seeking flexible, reliable payroll and HR solutions that can adapt to their evolving needs, from startups to large multinational corporations.

Pricing:

Starts at around £10 per employee per month

Pros:

- Comprehensive payroll and HR solutions

- Scalable for any business size

- Robust customer support

- Regular software updates

- Global compliance expertise

Cons:

- Can be costly for small businesses

- Complex setup process

- Additional costs for extra features

- Contract termination fees

- Data migration fees may apply

Further information:

Read our SD Worx review or visit the website.

Shape

Shape is a newcomer to the market, offering AI-driven analytics and a modern, user-friendly interface. Its customisable dashboard and high data security make it an interesting option for businesses willing to try new tech solutions.

Best suited for:

Businesses looking for a modern, analytics-driven payroll solution and willing to adapt to new technology.

Pricing:

Starts at £35 per month

Pros:

- AI-driven analytics

- Modern, user-friendly interface

- Customisable dashboard

- High data security

Cons:

- Limited customer reviews

- Expensive for small businesses

- Limited third-party integrations

- Advanced features may require training

Further information:

Read our Shape Payroll review or visit the website.

ShiftAI

ShiftAI offers streamlined payroll and HR solutions for UK SMEs, with features like automated HMRC submissions, integrated pensions, employee self-service, and scalable plans with robust support and custom integrations.

Best suited for:

Small to medium-sized UK businesses seeking an efficient, integrated payroll and HR system with HMRC compliance and customisable features.

Pricing:

£2 per month, or £24 per year, per employee.

Pros:

- Automated payroll saves time, reduces errors

- Integrates with accounting, pension platforms

- User-friendly interface

- Scalable pricing for startups to SMEs

- Self-service portal for employees

- Mobile app for on-the-go management

- Varied customer support options

- Payroll processed in 2-4 minutes

Cons:

- Learning curve for new users

- Only iOS app available

- Monthly base fee on some plans

- Custom integrations for higher plans only

- Business Plan demo by request

- Annual commitment for best rates

- Limited international payroll functionality

- Advanced features on Business Plan only

- No direct payment processing

Further information:

Read our ShiftAI review or visit the website.

Xero

Xero stands out for its strong mobile functionalities, making it ideal for businesses that require on-the-go payroll management. It offers good integration with accounting software and a user-friendly interface.

Best suited for:

Businesses needing a strong mobile payroll solution that integrates well with accounting software.

Pricing:

Starts at £11 per month

Pros:

- Strong mobile features

- Good integration with accounting software

- User-friendly interface

- Regular updates

Cons:

- Limited customisation options

- Monthly costs can add up

- Lacks advanced analytics

- Limited phone support

Further information:

Read our Xero payroll review or visit the website.

Zalaris

Zalaris is a leading provider of cloud-based HR and payroll solutions, offering comprehensive services including payroll processing, talent management, and HR analytics across multiple countries.

Best suited for:

Medium to large enterprises seeking scalable, comprehensive HR and payroll solutions with multi-country support and customisation options.

Pricing:

Starting at around £100 per month (estimated)

Pros:

- Comprehensive HR and payroll services

- Cloud-based, accessible anywhere

- Multi-country support for global businesses

- Customisable solutions available

- Scalable for growing companies

Cons:

- Potentially costly for small businesses

- Complexity may overwhelm small HR teams

- Customisation can add to overall costs

- Setup fees for SaaS model

Further information:

Read our Zalaris review or visit the website.

Zellis

Zellis offers comprehensive payroll and HR solutions, integrating seamless payroll processing, human capital management, and real-time reporting for UK businesses, ensuring compliance, efficiency, and scalability across various industries.

Best suited for:

Businesses of all sizes seeking a robust, scalable payroll and HR solution that ensures compliance with UK regulations and offers comprehensive reporting and management features.

Pricing:

Basic payroll starting from £50 per month, but with many additional and costly modules available

Pros:

- Comprehensive payroll and HR solutions

- Scalable for businesses of all sizes

- Ensures compliance with UK regulations

- Offers real-time reporting features

- Customisable to specific business needs

Cons:

- Can be costly for small businesses

- Complex setup for custom solutions

- Potential additional costs for premium features

- Learning curve for new users

Further information:

Read our Zellis payroll review or visit the website.

Conclusion – Choosing the best payroll software

The right payroll software for your business will depend on various factors including the size of your company, the complexity of your payroll needs, and your budget.

This comprehensive comparison aims to serve as a resourceful guide to streamline your decision-making process, offering insights into the pros, cons, and pricing of the top 16 payroll software packages in the UK.

FAQ for best UK payroll software

Below is an FAQ section to address some common questions you may have about selecting a payroll software for your UK business.

Payroll software automates the process of paying salaries to employees, taking into account deductions, benefits, and tax calculations.

It’s not mandatory, but using payroll software can help ensure that you’re in compliance with UK tax laws and regulations, which can be complex.

Yes, you can switch payroll software at any point. However, you will need to carefully migrate all the existing payroll data to the new system.

Key features to consider include tax compliance, reporting capabilities, ease of use, scalability, and customer support.

Some providers offer free versions of their software, but these are typically limited in terms of features and scalability.

Security protocols vary between providers, but most reputable companies offer robust data encryption and security features.

Each has its own pros and cons. Cloud-based software provides accessibility and real-time updates, while on-premises solutions may offer more customisation and control.

Some advanced payroll software options offer multi-currency support, but not all do. Check this feature if your business operates in more than one country.

Many modern payroll software packages are user-friendly and require minimal training. However, some advanced systems may require a learning curve.

Most leading payroll software can integrate with popular accounting systems like QuickBooks, Sage, and Xero.

The cost varies widely based on features, scalability, and the number of employees. Prices can range from as low as £8/month to custom quote-based pricing for larger enterprises.

Cloud-based solutions generally update automatically. For on-premises software, updates may need to be manually installed.

Yes, most payroll software helps with tax calculations and can automatically file reports with HMRC.

Absolutely. Reliable customer support can help resolve issues quickly, which is essential for smooth payroll processing.

Some software allows for high levels of customisation, while others offer a fixed set of features.

Potential downsides include software glitches, a steep learning curve for complex systems, and the possibility of high costs for advanced features.

Most modern payroll software options in the UK can handle auto-enrolment for pension contributions.

Yes, most payroll software can accommodate both hourly and salaried employees.

Most software can handle various types of compensation, including bonuses and commissions, as long as these are set up correctly in the system.

Yes, generating payslips is a standard feature in most payroll software packages.