Looking for the best free payroll software?

Managing payroll is an essential yet intricate part of running a business in the UK.

Given that payroll processing must adhere to HM Revenue and Customs (HMRC) regulations, companies often seek software solutions that simplify the process while ensuring compliance.

For small to medium-sized enterprises (SMEs) and startups, the cost factor can be a significant concern. Thankfully, there are free HMRC-compliant payroll software options available.

- Takes 2 minutes

- Receive quotes to compare

- Easy and no commitment

In this article, we’ll compare a few of the best free payroll software packages in the UK.

Free payroll software compared

| Software Name | Number of free employees | Features | Cost for additional employees | Pros | Cons |

|---|---|---|---|---|---|

| FreeAgent | No limit (with a qualifying business bank account) | Comprehensive accounting & payroll, expense tracking, invoicing | Starts at £19/month | All-in-one solution, Free with certain bank accounts, Regular updates | Complex for basic needs, Costs can escalate |

| IRIS Payroll Basics | 9 | Payslip creation, tax computations, HMRC submissions | Starts at £10.80/month | Simple interface, Free for up to 9 employees, HMRC compliant | Limited to 9 employees, Lacks advanced features |

| 12 Cloud Payroll | 9 | Auto-enrolment, payslip generation, basic reporting | £1/employee/month | Cloud-based, Advanced features, User-friendly | Limited to 9 employees, Security concerns |

| Capium Payroll | 3 | Payroll calculations, payslip generation, basic tax deductions | Starts at £6/month | Simple and intuitive, Core functionalities, Regular updates | Limited to 3 employees, Lacks features for complex needs |

| Shape Payroll | 3 | Payslip generation, tax calculations, year-end reports | Starts at £5/month | User-friendly, Basic functionalities, Quick setup | Limited to 3 employees, Lacks advanced features |

| Primo Payroll’s Essentials Free Plus | 10 | Payslip generation, tax computations, compliance reporting | Starts at £12/month | Supports up to 10 employees, Intuitive, Essential compliance reports | Limited features for complex needs, May not scale well |

| Enrolpay | 9 | 3 tiers available: Free, Assisted, and Fully Managed | Assisted service starts at £6/month for up to 4 employees | Transparent pricing with no hidden costs | Mobile app and holiday management not available on free plan |

| 12Pay | 9 | Various payslip printing options, and an Auto Enrolment Module | £79 + VAT per year | Free version allows up to 3 company payrolls on 1 account | No electronic payslips with free version, extra cost for Auto Enrolment and CIS |

Criteria for comparison

When comparing software, we looked at factors such as:

- HMRC compliance

- User interface and ease of use

- Feature set

- Customer support

- Scalability

Comparing 8 free payroll software packages

FreeAgent

Features

FreeAgent serves as a comprehensive accounting and payroll software package, tailored for small businesses and freelancers. It offers a wide range of features, from expense tracking and invoicing to tax calculations, in addition to payroll management.

What’s available for free?

Though FreeAgent is usually a paid service, it becomes free if you hold a business bank account with NatWest, Royal Bank of Scotland or Ulster Bank (or Mettle, as long as you engage in at least one transaction a month).

- Give your requirements

- Receive quotes to compare

- Choose a provider or walk away - your choice!

Outside of this offer, pricing starts at £19 per month for the initial 6 months, increasing to £29 per month thereafter.

Pros

- All-in-one accounting and payroll solution, providing seamless integration.

- Free usage available through partnerships with certain banks.

- Regular updates and support available.

Cons

- Could be too complex for users who only require simple payroll services.

- Costs can escalate if you don’t qualify for the free option.

Suitability

Best for small businesses looking for a comprehensive accounting package that includes payroll features.

Further information

Read our FreeAgent payroll review or visit the website.

IRIS Payroll Basics

Features

This software from IRIS focuses on the essentials, offering basic payroll functions like payslip creation, tax computations, and submissions to HMRC via RTI.

What’s available for free?

IRIS Payroll Basics is free but limited to up to 9 employees. For businesses that exceed this, paid plans start at £10.80 per month.

Pros

- Uncomplicated and user-friendly interface.

- Absolutely free for small-scale operations.

- Complies with HMRC regulations.

Cons

- Capped at 9 employees for the free version.

- Lacks advanced features found in more comprehensive solutions.

Suitability

An ideal choice for very small businesses with simple payroll needs.

Further information

Read our IRIS payroll review, or visit the website.

12 Cloud Payroll

Features

Being cloud-based, 12 Cloud Payroll offers a flexible solution with functionalities like auto-enrolment, payslip generation, and basic reporting.

What’s available for free?

The software is free for up to nine employees, with additional employee pricing starting at £1 per employee per month.

Pros

- Cloud-based architecture provides flexibility and remote access.

- Includes more advanced features like auto-enrolment for pensions.

- User-friendly interface.

Cons

- Free version restricted to 9 employees.

- Some users may find cloud-based solutions less secure.

Suitability

Great for small to medium-sized businesses comfortable with cloud-based platforms and in need of advanced functionalities.

Further information

Read our 12Cloud payroll review, or visit the website.

Capium Payroll

Features

Capium Payroll offers an intuitive platform with essential payroll features like payroll calculations, payslip generation, and basic tax deductions.

What’s available for free?

The software is free for up to three employees. Beyond that, subscriptions start at £6 per month.

Pros

- Simplified and intuitive user interface for ease of use.

- Includes all the core payroll functionalities needed for a small business.

- Regular software updates.

Cons

- Only supports up to 3 employees on the free tier.

- May lack features for more complex payroll operations.

Suitability

Best suited for micro-businesses or start-ups with a small number of employees and straightforward payroll needs.

Further information

Read our Capium payroll review or visit the website.

Shape Payroll

Features

Shape Payroll provides a straightforward solution for payroll services, offering payslip generation, tax calculations, and year-end reports.

What’s available for free?

The software is free for up to three employees. Additional employee pricing starts at £5 per month.

Pros

- User-friendly, easy-to-navigate interface.

- Covers basic payroll functionalities effectively.

- Quick setup and implementation.

Cons

- Limited to 3 employees in the free tier.

- Lacks advanced features for more complicated payroll scenarios.

Suitability

A solid option for freelancers and micro-businesses that have basic payroll requirements.

Further information

Read our Shape payroll review or visit the website.

Primo Payroll’s Essentials Free Plus

Features

Primo Payroll’s Essentials Free Plus offers an easy-to-use platform with basic payroll functionalities such as payslip generation, tax computations, and compliance reporting.

What’s available for free?

This free tier accommodates up to 10 employees. For additional employees, pricing starts at £12 per month.

Pros

- Supports up to 10 employees in its free tier, higher than most other free options.

- Intuitive interface makes it easy for beginners.

- Provides essential compliance reports.

Cons

- Limited range of features for complex payroll needs.

- May not scale well for rapidly growing businesses.

Suitability

A strong fit for small businesses that have up to 10 employees and need just the essential payroll functions.

Further information

Read our Primo Payroll review or visit the website.

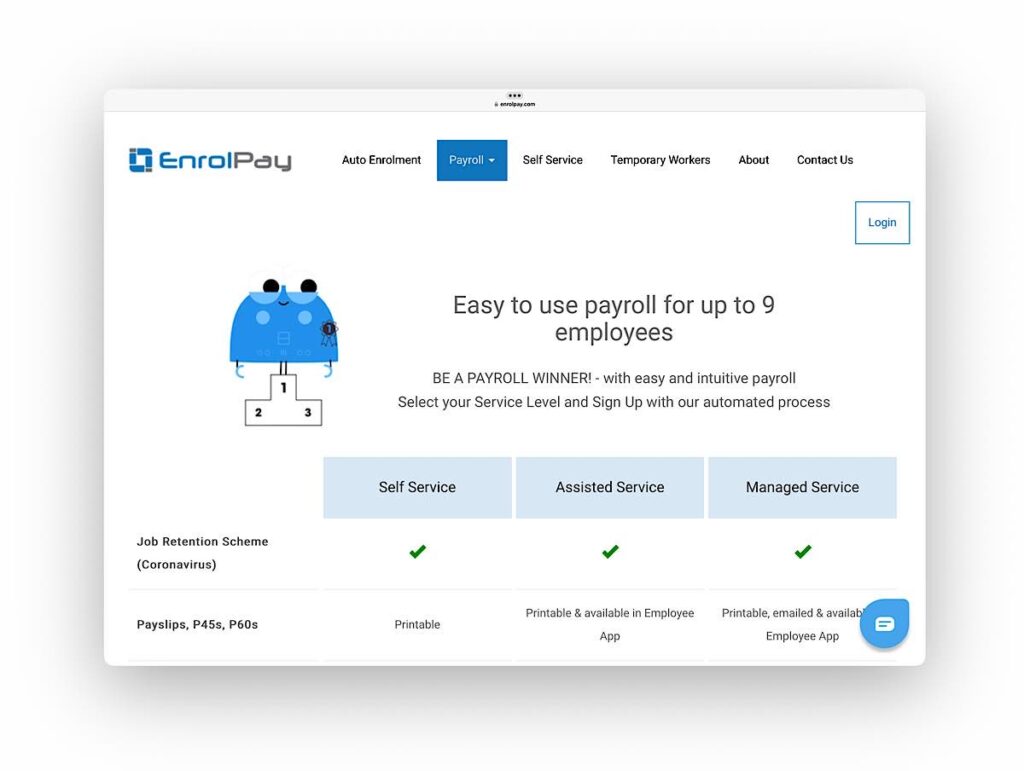

Enrolpay

Features

Enrolpay offers scalable payroll services including RTI submissions, automatic payroll calculations, and workplace pension management, with a free mobile app in upper-tier plans.

What’s available for free?

Pricing starts free for self-service with up to 9 employees, assisted service from £6 per month, and managed service at £22 per month, excluding VAT.

Pros

- Comprehensive payroll solutions for small to large businesses

- User-friendly Employee Self Service portal

- Transparent pricing with no hidden fees

- Supports a wide range of payroll frequencies

Cons

- Limited features in the free tier

- Chargeable support for the attachment of earnings function

- Holiday management only in the managed service tier

Suitability

Enrolpay is well-suited for UK-based businesses of all sizes seeking a flexible and comprehensive payroll service with a clear cost structure.

Further information

Read our Enrolpay payroll review or visit the website.

12Pay

Features

12Pay offers HMRC-recognised payroll software with features like tax and NI calculations, RTI reporting, various payslip printing options, and an Auto Enrolment Module, catering to different business sizes.

What’s available for free?

The Express edition is free, the Premium edition costs £79+VAT per annum, and the Bureau edition is priced at £156+VAT annually, with optional modules available at additional costs.

Pros

- Free option available for small businesses

- Easy upgrade path as the business grows

- Comprehensive features in paid versions

- Supports unlimited companies and employees in the Bureau edition

Cons

- Limited features in the free Express edition

- Additional cost for Auto Enrolment and CIS extensions

- No e-payslip option in the free version

Suitability

12Pay is ideal for UK-based businesses of all sizes seeking a scalable payroll solution, from startups with few employees to large bureaus managing multiple payrolls.

Further information

Read our 12Pay payroll review or visit the website.

Conclusion – Best free payroll software in the UK

Choosing free payroll software in the UK involves a variety of considerations, such as the size of your workforce, the specific features you require, and any additional accounting functionalities you may need.

Whether you’re looking for a comprehensive solution like FreeAgent or a simpler, more focused platform like IRIS Payroll Basics, the market has multiple options to suit your specific business requirements.

FAQ for free payroll software

Yes, some payroll software options offer genuinely free plans. However, these usually come with limitations such as the number of employees you can manage or the features available.

Most reputable free payroll software options are HMRC-compliant. Always check this aspect before choosing a software.

You can generally expect core features like wage calculations, payslip generation, and basic tax calculations.

Some free options offer pension auto-enrolment features, but not all do. Check the feature list carefully.

This varies by software. Some limit you to as few as three employees, while others may offer more flexibility.

Most modern free payroll solutions are cloud-based, although there are some downloadable options available.

Integration capabilities vary. Some free payroll software solutions offer seamless integration with popular accounting software, while others do not.

Customer support varies by provider. Some offer robust support even for free plans, while others may offer limited or no support.

Reputable free payroll software solutions generally use encryption and other security measures to protect your data, but always perform your due diligence.

Most free payroll software solutions offer a paid version that you can upgrade to as your business grows.

Most free payroll software is designed to be user-friendly, but the level of ease varies. Some may offer free tutorials or guides.

Data migration capabilities depend on the software. Some make it easy to export and import data, while others might not.

Most HMRC-compliant free payroll software will allow you to file submissions directly.

This varies by software. Check the feature list to see if year-end tax forms are included.

Some free software options provide features for bonuses, commissions, and overtime, while others might not.

Free software may limit you to a single pay schedule. Check the limitations before choosing a software.

Some free payroll software options are suitable for freelancers, particularly those that integrate with accounting software.

Most reputable free payroll software is regularly updated for tax tables and other regulatory changes.

Customisation options vary. Some free versions allow basic customisation, while others do not.

This varies by software. Some offer mobile apps or mobile-friendly websites, while others may require you to use a desktop for payroll processing.