If you’re seeking a payroll outsourcing bureau for your Leeds-based business, then this article should have what you need. Here we review the top 8 payroll companies in Leeds, giving you the key facts to help you choose a nearby payroll outsourcing provider for your business.

Best payroll companies in Leeds

- Care Accountancy

- Cheney Payroll Consulting and Bureau Services Ltd

- DS Accountancy and Bookkeeping Services

- Lima Accountancy

- Money Matters Leeds

- Northern Accountants Leeds

- RS Accountancy

- The Accounting Company Leeds Ltd

Care Accountancy

- Payroll processing services

- Data entry for remuneration info, new employees, leavers etc

- Student loan deductions

- Auto enrolment and pensions management

- Reporting

- Year-end, P60s etc

- Remuneration plans for directors

- Reduced compliance for internees, students, and part-time employees

- Tax-free employee rewards and incentive schemes

Prices:

- Accountancy services from £95 per hour + VAT

- Payroll processing from £35 + VAT per month

Website:

Email address:

Phone number:

0113 8870 218

- Takes 2 minutes

- Receive quotes to compare

- Easy and no commitment

Address:

94 Street Lane

Rhoundhay

Leeds

LS8 2AL

Reviews:

- Facebook: 5 out of 5 based on 30 reviews

- Google: 4.9 out of 5 based on 109 reviews

- Trustpilot: 3.9 out of 5 based on 17 reviews

Cheney Payroll Consulting and Bureau Services Ltd

- Produce employee payslips

- Standard payroll reports per pay period

- Produce P45 when required

- Advise HMRC liability for each period

- Completion and years end Filing to HMRC

- Completion of end of year forms P60

- SSP / SMP / SPP / SAP calculation

- Occupational Sickness recording

- Leave recording

- Submitting EPS & FPS returns to HMRC

Prices:

- Payroll processing costs £3.50 + VAT per person per month

- Payment services – payments to employees via Telleroo:

- Up to 10 transactions per month – £5

- Up to 25 transactions per month – £25

- Up to 100 transactions per month – £50

- Up to 250 transactions per month – £100

- Up to 500 transactions per month – £180

- Up to 750 transactions per month – £270

- Up to 1000 transactions per month – £350

- Up to 1500 transactions per month – £490

- Up to 2000 transactions per month – £640

Website:

https://cheneypayrollservices.co.uk

Email address:

martyn@cheneypayrollservices.co.uk

Phone number:

01133 609 398

- Give your requirements

- Receive quotes to compare

- Choose a provider or walk away - your choice!

Address:

Suite E7.5

Josephs Well

Hanover Walk

Leeds

LS3 1AB

Reviews:

DS Accountancy and Bookkeeping Services

- Weekly and monthly payrolls

- Onboarding and offboarding personnel

- Managing P45 and P60 documentation

- Fixed monthly fee

- Other accountancy and bookkeeping services

- Bank reconciliation

- VAT returns

- Management accounts

- Tax planning

Prices:

- Accountancy services from £85 + VAT per hour

- Payroll services from £50 per month

Website:

https://www.dsaccountancybookkeeping.co.uk

Email address:

info@dsaccountancybookkeeping.co.uk

Phone number:

07442200207

Address:

120 Queensway

Yeadon

Leeds

LS19 7PB

Reviews:

- Google: 5 out of 5 based on 8 reviews

Lima Accountancy

- Scheme set up with HMRC and starter/leaver processing

- Advice in relation to Statutory payments and ensuring the correct legal amounts are paid

- Completion of payroll calculations as per your chosen pay frequency and issue of payslips

- Submissions online to HMRC and advice of payment deadlines to HMRC

- Pension set up assistance, ongoing calculations and data submission to the Pension Provider

Prices:

- Prices not listed by vendor

- Payroll services on a per-payslip pricing model with a minimum monthly fee

Website:

https://www.limaaccountancy.co.uk

Email address:

enquiries@limaaccountancy.co.uk

Phone number:

Address:

132 Street Lane

Gildersome

Leeds

West Yorkshire

LS27 7JB

Reviews:

- Google: 4.9 out of 5 based on 38 reviews

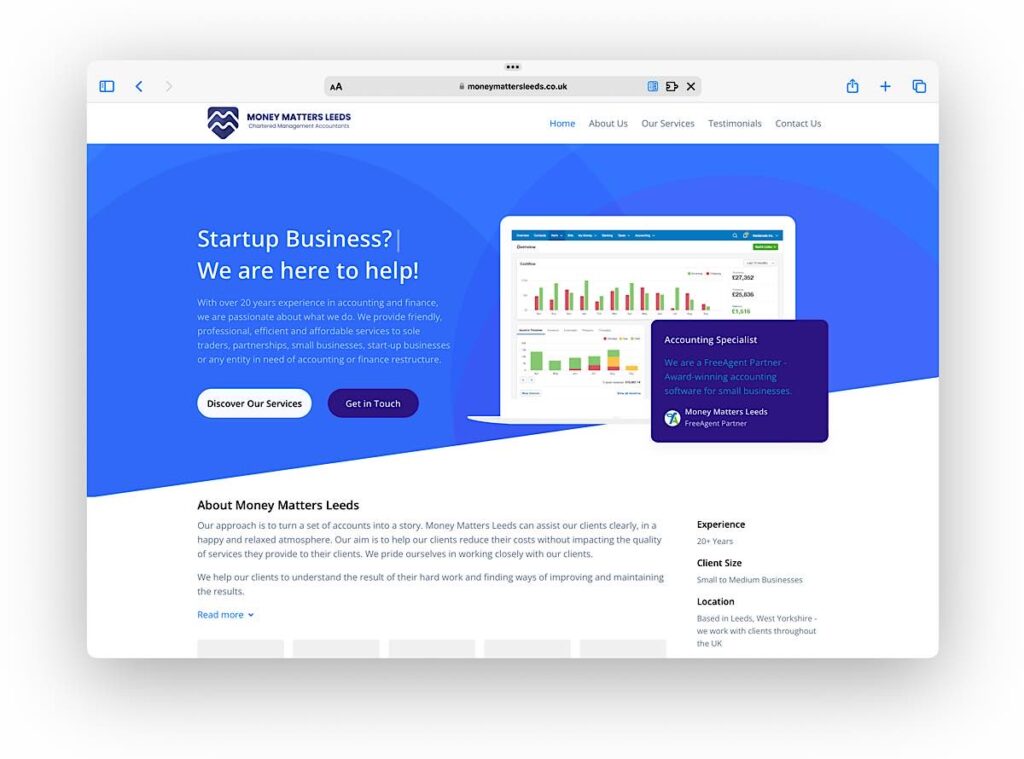

Money Matters Leeds

- Payroll processing

- Data entering

- Producing payslips / P45s / P60s

- Organising BACS payments and FPS submission

- Benefit in Kind and P11D submission

- Bookkeeping

- Management accounts

- Year end accounts

- VAT returns

- R&D tax relief

- Company formation

Prices:

- Accountancy services from £75 per hour + VAT

- Payroll processing from £40 per month

Website:

https://moneymattersleeds.co.uk

Email address:

Phone number:

07465 442 462

Address:

12A Beechroyd

Pudsey

Leeds

LS28 8BH

Reviews:

- Google: 5 out of 5 based on 28 reviews

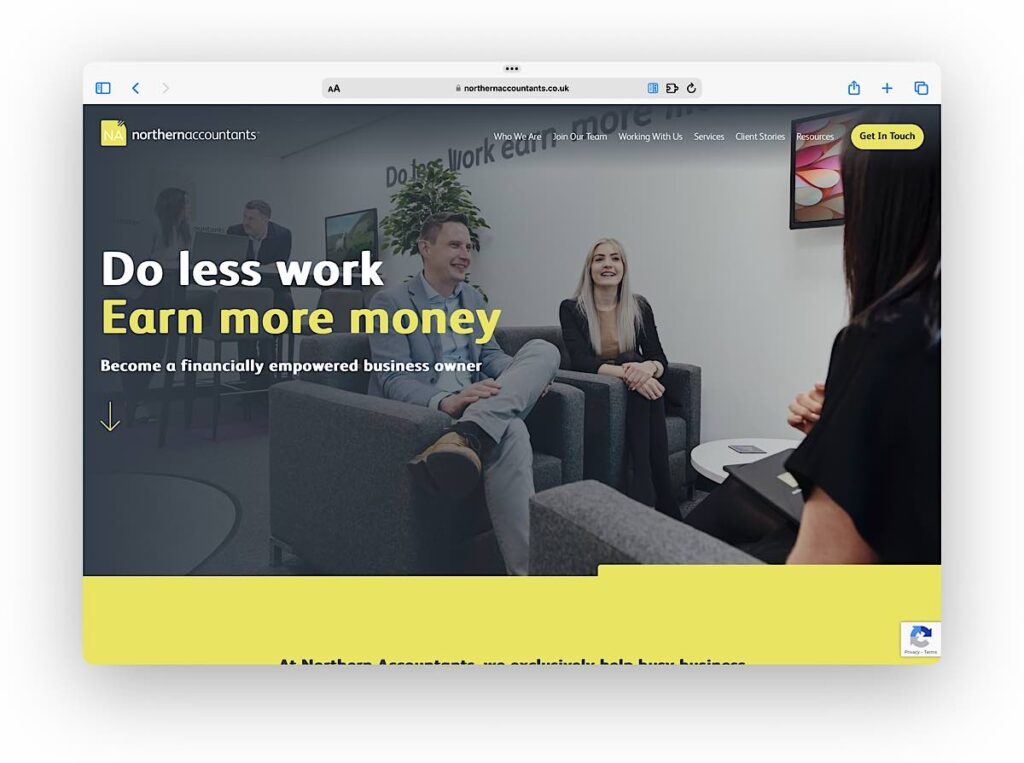

Northern Accountants Leeds

- Accountancy services including payroll management

- Accurate and timely payroll

- Pensions administration

- P11D

- Statutory pay calculations

- PAYE setup and management

- HMRC submissions

- Payments made on your behalf

Prices:

- Accountancy services from £90 + VAT per hour

- Payroll management from £45 per month

- Free consultation available

Website:

https://www.northernaccountants.co.uk

Email address:

enquiries@northernaccountants.co.uk

Phone number:

0113 218 9552

Address:

Olympus House

2 Howley Park Business Village

Pullan Way

Leeds

LS27 0BZ

Reviews:

- Facebook: 5 out of 5 based on 14 reviews

- Google: 5 out of 5 based on 72 reviews

- Trustpilot: 3.7 out of 5 based on 1 review

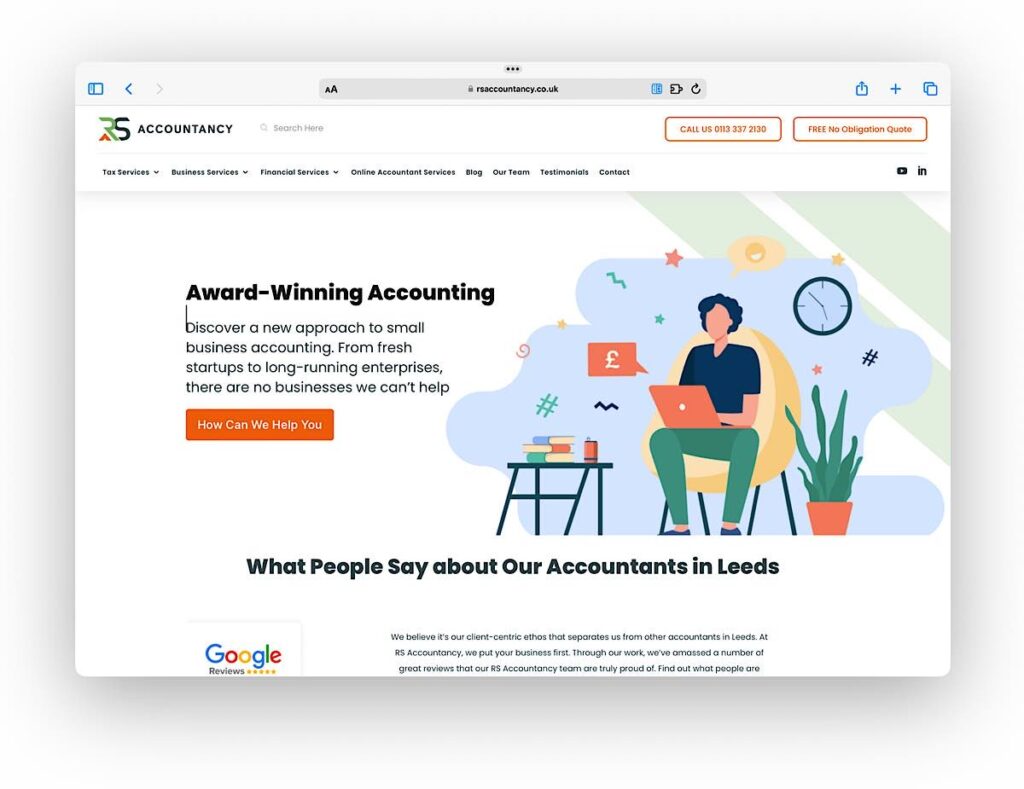

RS Accountancy

- Production of customised payslips

- Administration of PAYE, national insurance, statutory maternity pay and statutory sick pay

- Assurances of confidentiality of information

- Completion of statutory forms that can be issued to employees, as well as submitted to HMRC

- The provision of summaries, payroll reports and analysis of staff costs

- Administration of bonuses, termination payments and incentive schemes

- Administration of pension schemes

Prices:

- Prices not listed by vendor

- Payroll management on a price-per-paylip basis

- Minimum monthly fee may apply

Website:

Email address:

Phone number:

0113 337 2130

Address:

Building 4

Carrwood Park

Swillington Commons

Selby Rd

Leeds

LS15 4LG

Reviews:

- Google: 4.7 out of 5 based on 78 reviews

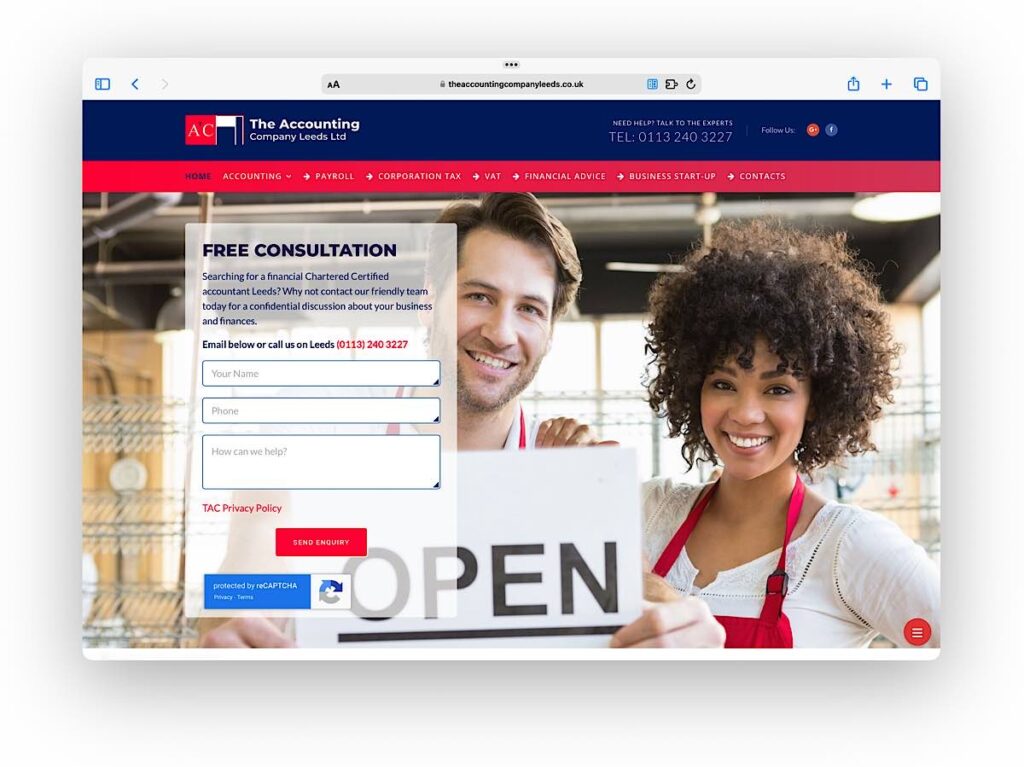

The Accounting Company Leeds Ltd

- Customised payslips

- Administration of PAYE, National Insurance, statutory sick pay, statutory maternity pay, etc

- Completion of statutory forms, including year end returns, to issue to employees and submit to HMRC

- Summaries and analyses of staff costs

- Administration of incentive schemes, bonuses, and ex-gratia and termination payments

- Administration of pension schemes

- Real Time Information reporting

- Payroll year end compliance (P60s etc)

- Redundancies

Prices:

- Prices not listed by vendor

- Per-payslip fee for payroll with a minimum monthly fee

Website:

https://www.theaccountingcompanyleeds.co.uk

Email address:

Phone number:

0113 240 3227

Address:

172 Easterly Road

LEEDS

LS8 3AD

West Yorkshire

Reviews:

- Facebook: 5 out of 5 based on 35 reviews

- Google: 5 out of 5 based on 37 reviews

- Yell.com: 5 out of 5 based on 2 reviews

How we determined our rankings – Evaluation criteria

To compile a list of the leading payroll service providers in Leeds, we conducted a thorough assessment based on several critical factors. Here’s the criteria we used to evaluate each provider:

- Local reputation based on online reviews: We meticulously reviewed client testimonials and online feedback from Leeds-based businesses. Providers that consistently demonstrated high levels of customer satisfaction, accuracy in payroll management, and excellent client support were ranked highly.

- Professional accreditation: We considered the professional accreditations held by each provider, which signify adherence to industry standards and a commitment to quality. Providers with recognitions from authoritative bodies, such as the Chartered Institute of Payroll Professionals (CIPP), were deemed more reliable and competent.

- Pricing: Our evaluation of pricing focused on transparency and fairness. We favoured providers that offer clear pricing structures without hidden fees, ensuring that businesses in Leeds can budget their payroll expenses effectively and avoid unexpected costs.

- Suitability of payroll management services: We analysed the range and adaptability of the payroll services offered, assessing how well they cater to the specific needs of the diverse Leeds business community. This included evaluating their proficiency in handling statutory compliance, such as tax obligations and pension schemes, and their capability to scale services for both small firms and large corporations.

FAQ – Payroll services companies in Leeds

Payroll services companies in Leeds provide a broad spectrum of payroll management solutions to accommodate the diverse needs of businesses. These services typically encompass the calculation of employee pay and deductions, tax and National Insurance contributions management, pension contributions handling including auto-enrolment, issuance of electronic or paper payslips, statutory payments processing (e.g., sick, maternity, or paternity pay), and the submission of Real Time Information (RTI) to HMRC. Advanced offerings may include support for expatriate payroll, bespoke payroll reporting, integrated HR services, and payroll compliance consultancy.

Selecting the best payroll provider in Leeds involves several critical steps:

Identify Your Needs: Clearly outline your payroll requirements, considering any specific complexities of your business.

Research and Recommendations: Look for providers with strong expertise in your industry and positive recommendations from similar-sized businesses.

Evaluate Compliance and Accuracy: Ensure the provider is up-to-date with UK payroll legislation and has a reputation for accuracy in their services.

Assess Integration Capabilities: Check if the provider’s systems can integrate with your existing HR and accounting software.

Consider Security Measures: Investigate the provider’s data protection and privacy practices to safeguard sensitive payroll information.

Examine Customer Support: Evaluate the quality of customer support offered, including the availability of dedicated account managers or payroll experts.

Compare Pricing: Understand the pricing structure to ensure it aligns with your budget and offers value for the services provided.

It’s also beneficial to schedule consultations with potential providers to better understand their service offerings and how they can meet your specific needs.

Yes, small and medium-sized enterprises (SMEs) in Leeds can significantly benefit from outsourcing their payroll services. Outsourcing can provide SMEs with access to payroll expertise and technology without the need for substantial in-house investment in software, training, or personnel. It helps ensure payroll accuracy, compliance with legislation, and can offer scalability as the business grows. Additionally, outsourcing payroll allows SME business owners and managers to focus on strategic growth areas by reducing the administrative burden of payroll processing.