Here we list and review the 7 best Birmingham payroll services companies, helping you shortlist the best payroll outsourcing provider for your Birmingham-based business. If you’re looking for a payroll services company based in the West Midlands, then look no further.

Best payroll companies in Birmingham

- Agile Accountants

- JLP Payroll Services Ltd

- Naseems Accountants

- Peer Accountants

- Pytronot Payroll Solutions

- Secure Accounts Limited

- Taxcare Accountants

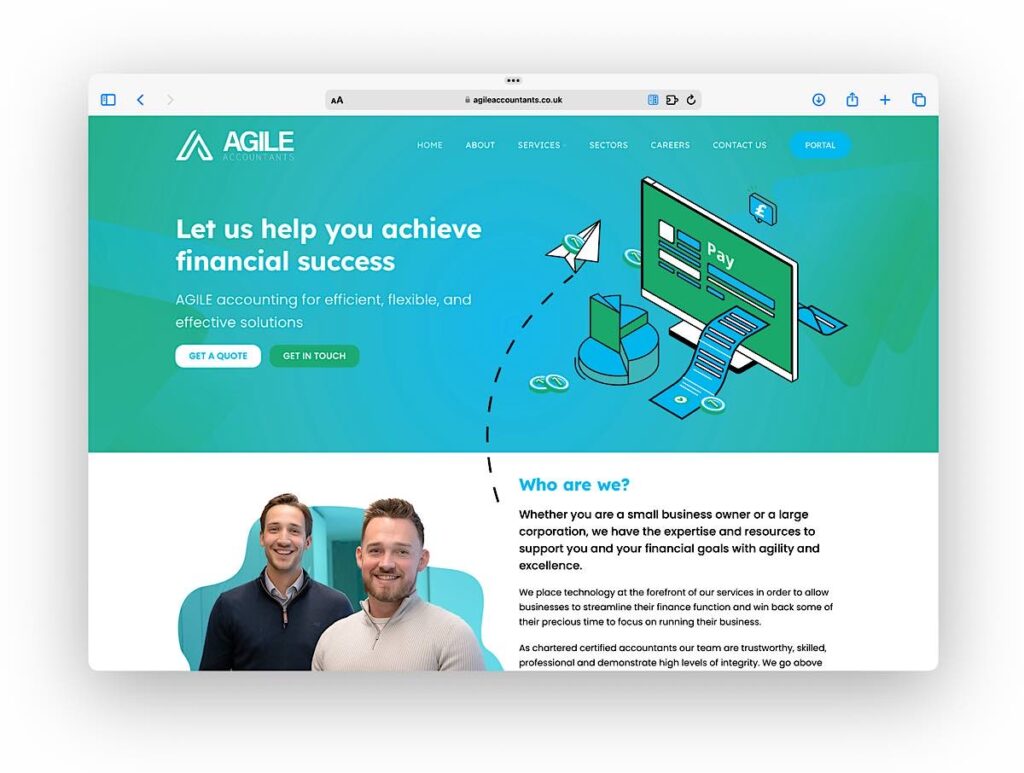

Agile Accountants

- Offers payroll services as well as broader accounting services

- ”Build a package” service where clients can pick and choose tailored services

- ACCA registered accountants

- Caters to sole traders, companies, and mentions influencers and content creators

Prices:

- From £95 per hour + VAT for accounting services

- Payroll on a per-payslip basis with a minimum monthly fee

Website:

https://agileaccountants.co.uk

Email address:

Phone number:

01215 170 262

- Takes 2 minutes

- Receive quotes to compare

- Easy and no commitment

Address:

The Colmore Building

20 Colmore Circus

Queensway

Birmingham

B4 6AT

Reviews:

- Google: 5 out of 5 based on 87 reviews

JLP Payroll Services Ltd

- Flexible pay periods including weekly, fortnightly, 4 weekly, monthly and quarterly

- All types of pay: basic, overtime, holiday pay, sick pay, statutory maternity pay, pensions, student loans

- Supports salary payment methods including cash and BACS

- Departmental breakdowns provided

- Will distribute payslips to employees on your behalf

- Files kept for each employee

Prices:

- From £4.00 per payslip

- Minimum monthly payroll charge may apply

Website:

Email address:

Phone number:

0121 422 0550

- Give your requirements

- Receive quotes to compare

- Choose a provider or walk away - your choice!

Address:

85 Whitely Court Road

Quinton

Birmingham

B32 1EZ

Reviews:

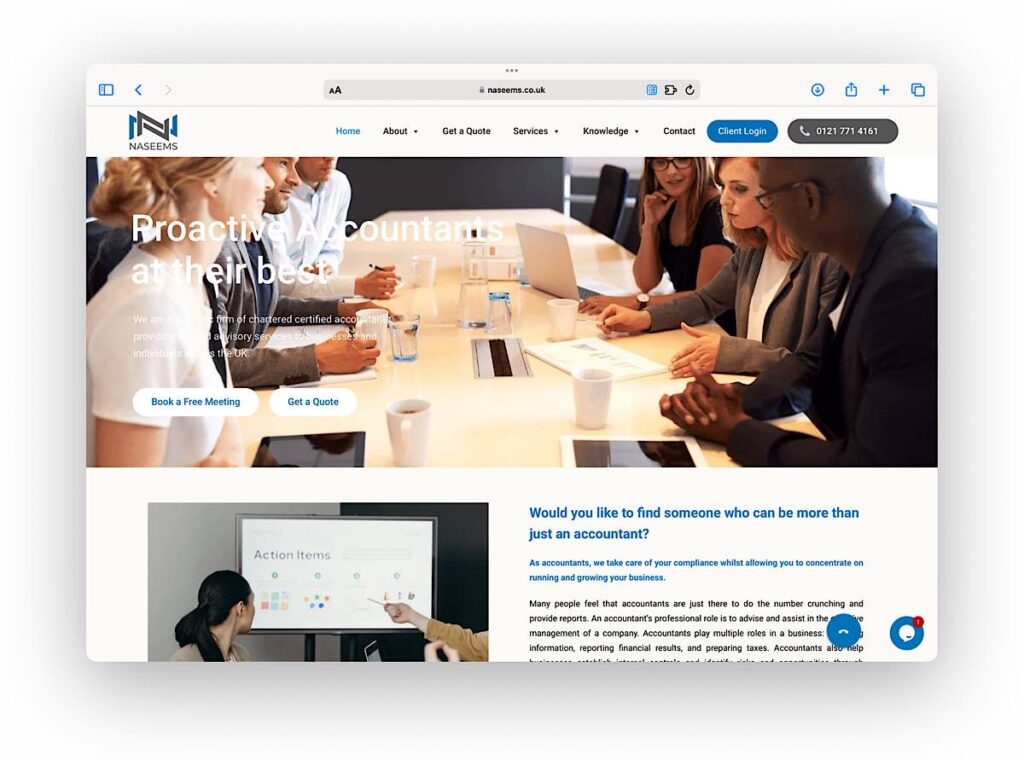

Naseems Accountants

- Clients in sectors including pharmaceuticals, healthcare, clothing and textiles, manufacturing

- General accounting as well as payroll services

- Operating locally in Birmingham but also nationally

- Tax services and company secretarial

Prices:

- Free initial meeting

- Fixed quote provided

- Flexible payment options including Direct Debit

Website:

Email address:

Phone number:

0121 771 4161

Address:

104 Stoney Lane

Balsall Heath

Birmingham

B12 8AF

Reviews:

- Google: 5 out of 5 based on 75 reviews

- TrustPilot: 3.7 out of 5 based on 1 review

- Yell.com: 5 out of 5 based on 4 reviews

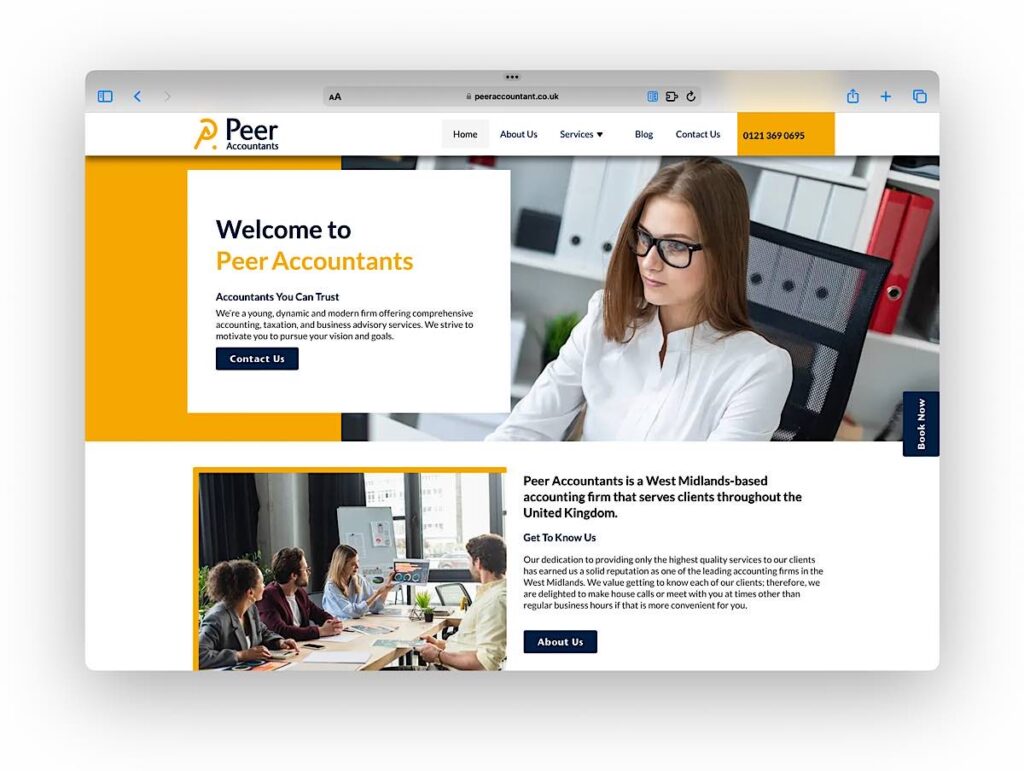

Peer Accountants

- Taxation, bookkeeping and accounting services

- Startup business support including help with business plans

- Payroll, auto enrolment, RTI submissions

- Calls, emails, and questions answered within 24 hours

- One point of contact with a dedicated client manager

Prices:

- From £95 + VAT per hour for accounting and tax management services

- Payroll based on a fee per payslip

Website:

https://www.peeraccountant.co.uk

Email address:

Phone number:

0121 369 0695

Address:

Trigate Business Centre

210-222 Hagley Rd W

Birmingham

B68 0NP

Reviews:

- Google: 4.9 out of 5 based on 36 reviews

- TrustPilot: 4.6 out of 5 based on 29 reviews

Pytronot Payroll Solutions

- Offers payroll services as well as recruitment services

- HR consultancy available

- Over 10 years experience

- Thorough knowledge of employment law

- Offers contractor services with no hidden fees

Prices:

- Not listed by vendor

- Likely a per-payslip fee with a minimum monthly charge

Website:

Email address:

Phone number:

0121 726 9227

Address:

449 Brays Road

Sheldon

Birmingham

B26 2RR

Reviews:

- Google: 5 out of 5 based on 13 reviews

- TrustPilot: 4.7 out of 5 based on 68 reviews

- Yell.com: 5 out of 5 based on 1 review

Secure Accounts Limited

- Offers payroll services as well as broader accounting and bookkeeping services

- ACCA registered accountants

- Payslips

- Online RTI submissions

- P45 and P60s

- Calculations of the payroll

Prices:

- From £7 per payslip + VAT

- Additional charges for extras such as pension auto enrolment

Website:

https://www.secureaccountsltd.co.uk

Email address:

Phone number:

0121 285 2534

Address:

Suite 2A

6 Floor, Cobalt Square

83-85 Hagley Road

Birmingham

B16 8QG

Reviews:

- Google: 5 out of 5 based on 111 reviews

- TrustPilot: 4.4 out of 5 based on 11 reviews

- Yell.com: 4.9 out of 5 based on 16 reviews

Taxcare Accountants

- General accountancy and bookkeeping as well as payroll services

- Specialists in all major accounting and payroll software including Xero, QuickBooks and Sage

- Migration services between these softwares

- Offers a full “virtual finance department” for its clients

Prices:

- Prices not listed by vendor

- Website offers “instant quote” in 30 seconds via interactive tool

Website:

Email address:

Phone number:

0121 368 1277

Address:

Alpha Tower

21st Floor

Suffolk Street

Queensway

Birmingham

B1 1TT

Reviews:

- Google: 5 out of 5 based on 48 reviews

- TrustPilot: 4.2 out of 5 based on 6 reviews

- Yell.com: 5 out of 5 based on 7 reviews

How we determined our rankings – Evaluation criteria

To compile our list of Birmingham’s top payroll service providers, we have evaluated several key aspects that reflect their performance and reliability. Here is the breakdown of the criteria used to assess each service:

- Local reputation based on online reviews: We have scoured online platforms to gather customer reviews pertaining to payroll services located in Birmingham. Providers that consistently receive positive feedback for their efficiency, customer care, and accuracy are rated more favourably.

- Professional accreditation: Our assessment places a strong emphasis on the provider’s professional credentials. Accreditation from esteemed bodies, such as the Chartered Institute of Payroll Professionals (CIPP), is considered a benchmark of professional excellence and reliability in the payroll sector.

- Pricing: We scrutinise the cost structure of each payroll provider to ensure they offer transparent and reasonable rates. Our rankings favour those that provide excellent service at a competitive price, while clearly communicating any additional charges.

- Suitability of payroll management services: In evaluating the appropriateness of the payroll services offered, we focus on how well they meet the specific requirements of Birmingham-based businesses. This includes the ability to efficiently manage local tax obligations, pension schemes, and employee benefits, which are essential for both small firms and larger corporations.

FAQ – Payroll services companies in Birmingham

Payroll services companies in Birmingham offer a comprehensive suite of payroll processing solutions tailored to meet the needs of diverse business sectors. These solutions typically include calculating employee pay and deductions, managing tax obligations and National Insurance contributions, handling year-end reporting and P60s, processing statutory payments like sick pay and maternity pay, and managing pension contributions for auto-enrolment. Many providers also offer additional services such as HR support, customised reporting, and integration with existing business systems for a seamless payroll management experience.

Identifying the most suitable payroll provider in Birmingham involves several steps. Start by defining your business’s specific payroll needs, considering factors like company size, sector, and any unique requirements. Research providers with expertise in your industry and a proven track record of serving businesses similar to yours. Look for flexibility in service offerings, robust data security measures, compliance with UK payroll legislation, and positive customer reviews. It’s also wise to assess the level of customer support provided, including the availability of personalised advice and assistance. Arranging consultations with shortlisted providers can help clarify their suitability for your business.

Yes, SMEs in Birmingham can significantly benefit from outsourcing payroll services. Outsourcing can help SMEs manage payroll more efficiently and accurately, ensuring compliance with tax laws and employment regulations without the need to invest in specialised in-house resources. This approach not only saves time and reduces the administrative burden on business owners and managers but also minimises the risk of errors and penalties associated with payroll processing. Furthermore, outsourcing provides access to expert advice and advanced technology, allowing SMEs to focus on core business activities and growth strategies.