If you’re seeking a payroll outsourcing bureau for your Norwich-based business, then this article should have what you need. Here we review the top 8 payroll companies in Norwich, giving you the key facts to help you choose a nearby outsourced payroll provider for your business.

Best payroll services companies in Norwich

- Accountants Etc

- ATF Accountancy

- GLX-Accountants Norwich

- Larking Gowen

- Norwich Accountancy

- TaxAssist Accountants Norwich

- Taxsure

- Together Accounting

Accountants Etc

- Low cost accountants and tax advisers in Norwich

- Over 20 years experience in practice and industry

- Support small businesses or limited companies

- Specialise in Payroll solutions

Prices:

- Offers a free online quote

- Fees start from £24 per month

Website:

Email address:

Phone number:

01603931177

- Takes 2 minutes

- Receive quotes to compare

- Easy and no commitment

Address:

127 Unthank Rd

Norwich

NR4 7QB

Reviews:

ATF Accountancy

- Experienced payroll accountancy, up-to-date with relevant rules and regulations

- Payroll on weekly, fortnightly or monthly basis

- Submission of all relevant reports to HMRC

- Calculation of holiday pay, sick pay, maternity leave

- Issuance of P60 and P45

- Pension auto enrolment

Prices:

- Payroll processing from £3.75 per payslip

- Minimum monthly fee for small payroll runs

Website:

Email address:

Phone number:

01603669020

- Give your requirements

- Receive quotes to compare

- Choose a provider or walk away - your choice!

Address:

44-48 Magdalen St

Norwich

NR3 1JE

Reviews:

- Google: 5 out of 5 based on 85 reviews

GLX-Accountants Norwich

- Independent firm of chartered accountants

- Support organisations of all sizes and sectors

- Manage payroll with affordable and time-saving solutions

- Meet obligations as an employer with HMRC

- Digitally process payslips and payroll documentation

- Oversee pension scheme enrolment and payments

- Provide guidance on compliance associated with the Construction Industry Scheme (CIS)

Prices:

- Payroll processing from £32 per month

- Additional fees for extras such as pension scheme setup

Website:

Email address:

Phone number:

01603617361

Address:

69-75 Thorpe Rd

Norwich

NR1 1UA

Reviews:

- Google: 4.9 out of 5 based on 29 reviews

Larking Gowen

- Offer a committed expert to work closely with client

- Support with saving costs, time and resources

- Keep up to date with latest requirements

- Help with calculations such as tax, NI, holiday, sick pay

- Employment allowance claims

- PAYE scheme set up

- Pension set-up

- New employees set-up

Prices:

- Pricing not listed by vendor

- Payroll costed on a per-payslip basis

- Minimum monthly standing charge for small payrolls

Website:

https://www.larking-gowen.co.uk

Email address:

Phone number:

01603624181

Address:

Prospect House

Rouen Rd

Norwich

NR1 1RE

Reviews:

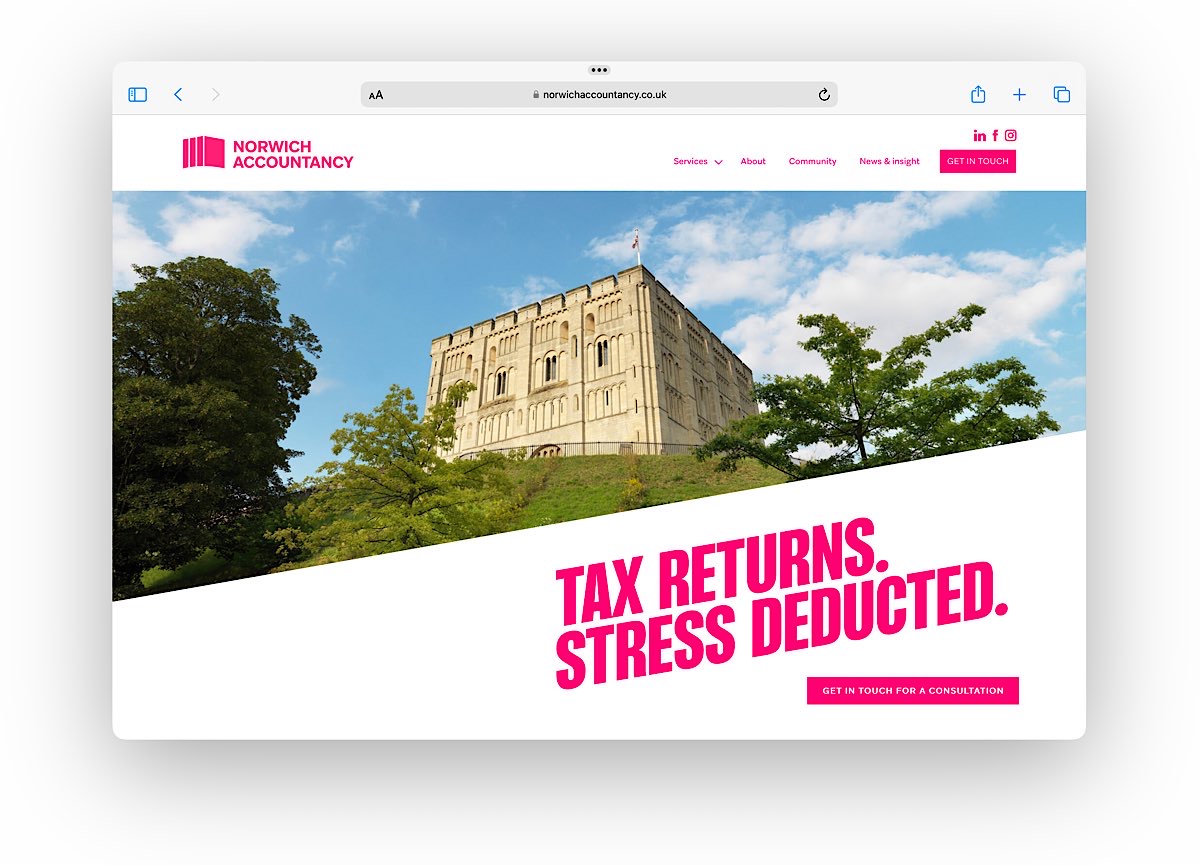

Norwich Accountancy

- Team of tax and accountancy experts

- Support sole traders, SMEs and entrepreneurs

- Issuing of payslips

- Statutory sick, maternity and paternity pay calculations

- Full HMRC RTI compliance

- Auto-enrolment set up, submissions and re-declarations

- National Insurance contributions

- Assistance with P11D benefits in kind

Prices:

- Payroll management starting at £40 per month

- Costed on a per-payslip basis with a minimum monthly charge

Website:

https://norwichaccountancy.co.uk

Email address:

Phone number:

01603630882

Address:

10A Castle Mdw

Norwich

NR1 3DE

Reviews:

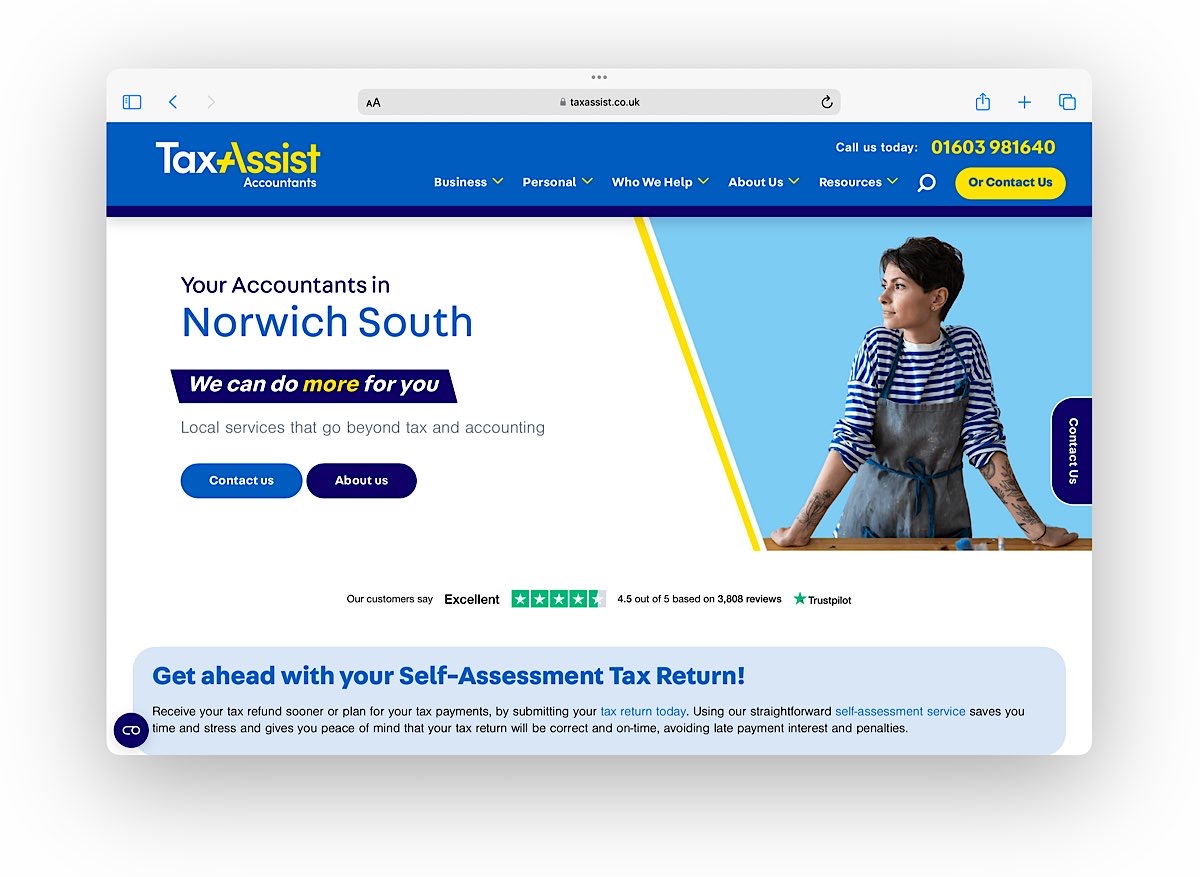

TaxAssist Accountants Norwich

- Provide access to a payroll portal which enables easy to manage employee working hours, securely store employee information, such as payslips and other related documents

- Alternatively they offer a payroll service that is tailored to your needs

- Oversee payroll processes, costs, calculations and deadlines to take care of everything for clients’ business

- Help with employment law

- Teamed up with Employmentor who can offer a legal helpline to answer queries about employing people along with providing letters and contract templates

Prices:

- Free initial meeting

- Pricing not listed by vendor

- Payroll costed on a per-payslip basis

Website:

https://www.taxassist.co.uk/norwich-south

Email address:

Phone number:

01603981640

Address:

113, 119 Ber St

Norwich

NR1 3EY

Reviews:

- Trustpilot: 4.5 out of 5 based on 3,796 reviews

- Google: 4.8 out of 5 based on 44 reviews

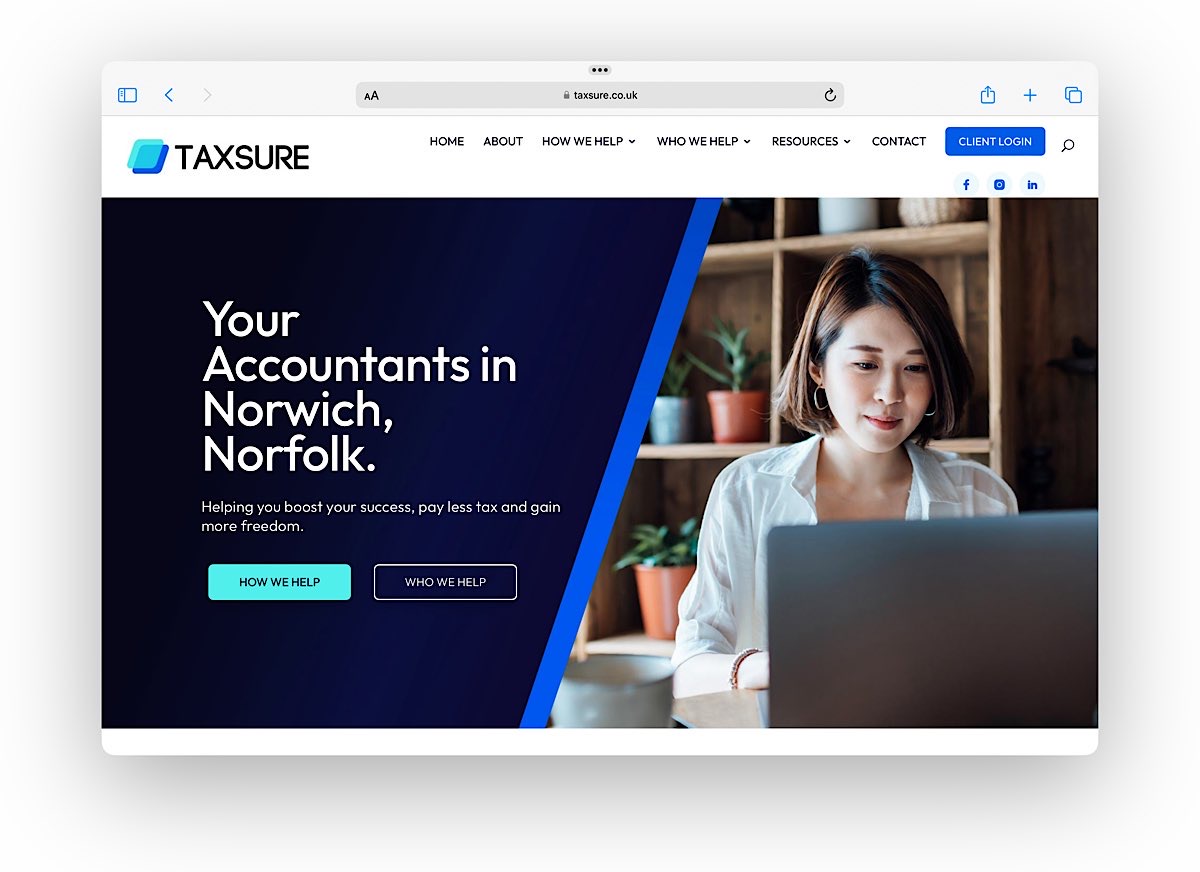

Taxsure

- Payroll processing: Accurate calculation of wages, deductions, and tax withholdings, tailored to the unique requirements of your business

- Real-time information (RTI) submissions: Timely and compliant submissions to HMRC, ensuring your business adheres to UK regulations

- End of year reporting: Comprehensive support with year-end processes, including P60s, ensuring you meet all statutory deadlines

- Auto-enrolment for pensions: Management of auto-enrolment processes, from initial assessment to ongoing administration, aligning with pension regulations

- Bespoke reporting: Custom reports providing insights into payroll costs, helping you manage budgets and forecast effectively

Prices:

- Free initial consultation

- Payroll management from £38 + VAT per month

Website:

Email address:

Phone number:

01603334100

Address:

92 St Faiths Ln

Norwich

NR1 1NE

Reviews:

- Google: 5 out of 5 based on 14 reviews

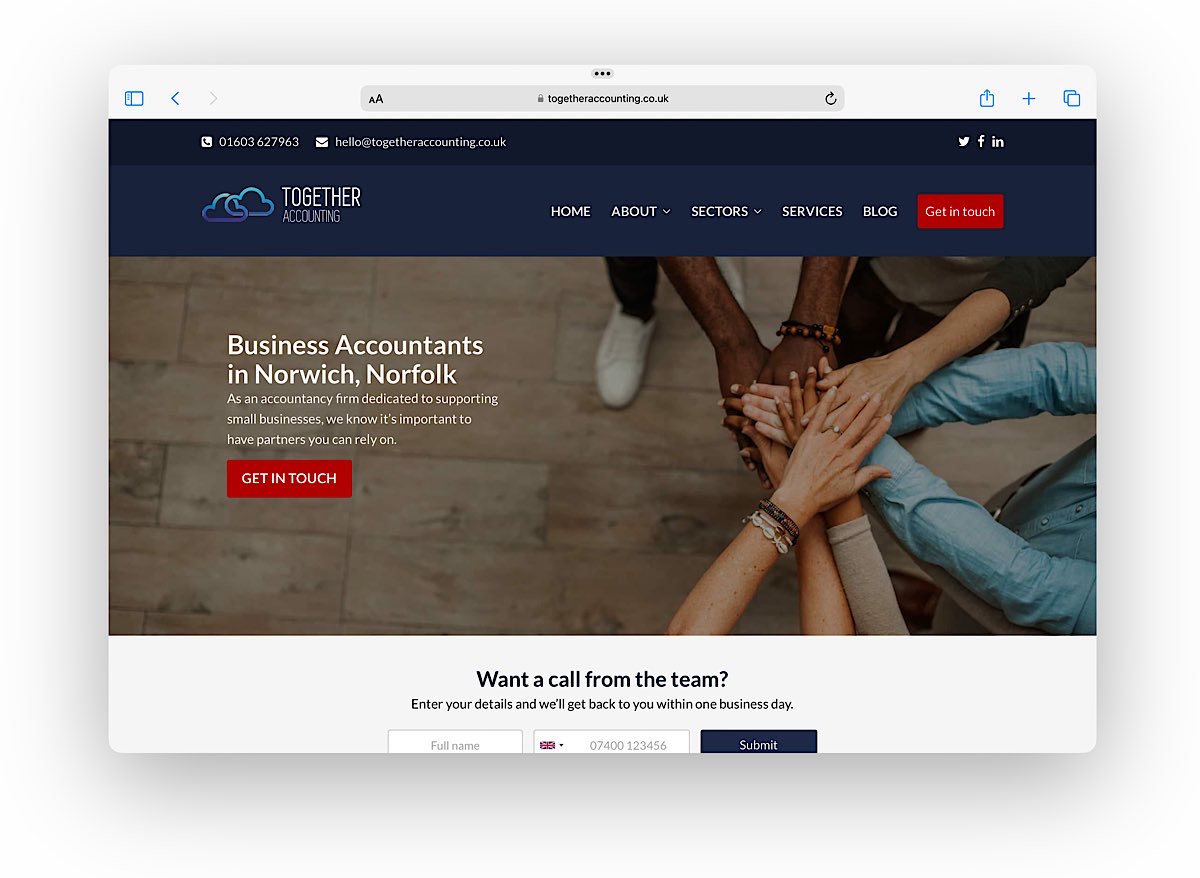

Together Accounting

- Small business accountants

- Setting up the payroll process

- Emailing payslips to your staff

- Arranging payments from your account

- Managing monthly summaries

- Reporting leavers and new starters to HMRC

- Advising on employee benefits and bonus schemes

Prices:

- Pricing not listed by vendor

- Payroll charges based on a cost per-payslip

Website:

https://www.togetheraccounting.co.uk

Email address:

hello@togetheraccounting.co.uk

Phone number:

01603627963

Address:

17-19 St Georges St

Norwich

NR3 1AB

Reviews:

- Google: 5 out of 5 based on 17 reviews

How we determined our rankings – Evaluation criteria

To compile our list of the top payroll service providers in Norwich, we engaged in a thorough evaluation process based on several essential criteria. Here’s how we assessed each provider:

- Local Reputation Based on Online Reviews: We carefully reviewed online reviews and feedback from businesses based in Norwich. Providers that consistently demonstrated excellence in payroll accuracy, exceptional customer service, and reliability were rated highly.

- Professional Accreditation: We placed significant emphasis on professional accreditations, which are critical indicators of a provider’s commitment to quality and adherence to industry standards. Providers that are certified by reputable organizations, such as the Chartered Institute of Payroll Professionals (CIPP), received higher scores for their demonstrated professionalism and expertise.

- Pricing: Transparency in pricing is crucial for any business. We analyzed each provider’s pricing structure, favoring those that offer clear, competitive rates without hidden charges. This approach ensures that businesses in Norwich can plan their payroll expenses effectively, avoiding any surprises.

- Suitability of Payroll Management Services: We assessed the suitability of the payroll services offered, focusing on their ability to meet the specific needs of Norwich’s business community. This included their capacity to efficiently manage essential payroll functions such as tax calculations, pension contributions, and employee benefits, suitable for both small businesses and larger enterprises.

FAQ – Payroll services companies in Norwich

When evaluating payroll providers in Norwich, consider their industry experience, customer feedback, and ability to handle complex payroll requirements. Check for a strong track record of regulatory compliance and the flexibility to scale services as your business grows. It’s also beneficial to look at their technological capabilities and how they’ve integrated innovations into their service offerings.

Payroll software in Norwich should offer robust integration with existing HR and accounting systems, real-time reporting capabilities for timely decision-making, an intuitive user interface for ease of use, and mobile access to accommodate on-the-go management. Advanced features like automated tax updates, employee self-service portals, and customisable pay runs are also important for efficient payroll management.

Many payroll providers in Norwich are equipped to handle international payroll requirements, offering services such as multi-currency support and expertise in international compliance issues. When choosing a provider, ensure they have experience with the specific tax regulations and employment laws of the countries where your employees are located, as well as the necessary software capabilities.

Typical pricing for payroll services in Norwich include per employee per month (PEPM), which varies based on the number of employees, and flat monthly fees that cover all payroll services regardless of employee count. Some providers may also charge additional fees for setup, custom reporting, and end-of-year processing. Always ask for a detailed breakdown to avoid unexpected costs.

Payroll providers in Norwich secure data through advanced encryption protocols, both in transit and at rest. They utilize secure, compliant data centers with restricted access to protect against unauthorized entry. Regular security audits help identify and mitigate risks, and adherence to GDPR and other relevant data protection laws ensures that employee information is handled responsibly and securely.