If you’re trying to find a payroll service provider for your Bristol-based business, then look no further. Here we review the top 8 payroll companies in Bristol, giving you the key facts to help you choose an outsourced payroll solution for your business.

Best payroll companies in Bristol

- Albert Goodman Chartered Accountants

- Cox & Co Payroll Solutions Ltd

- MyAccountant.co.uk Ltd

- Octane Accountants Limited

- Park Street Accountants Ltd

- Stone & Co Chartered Accountants

- Total Books Bristol

- Whitestone Accounting Ltd

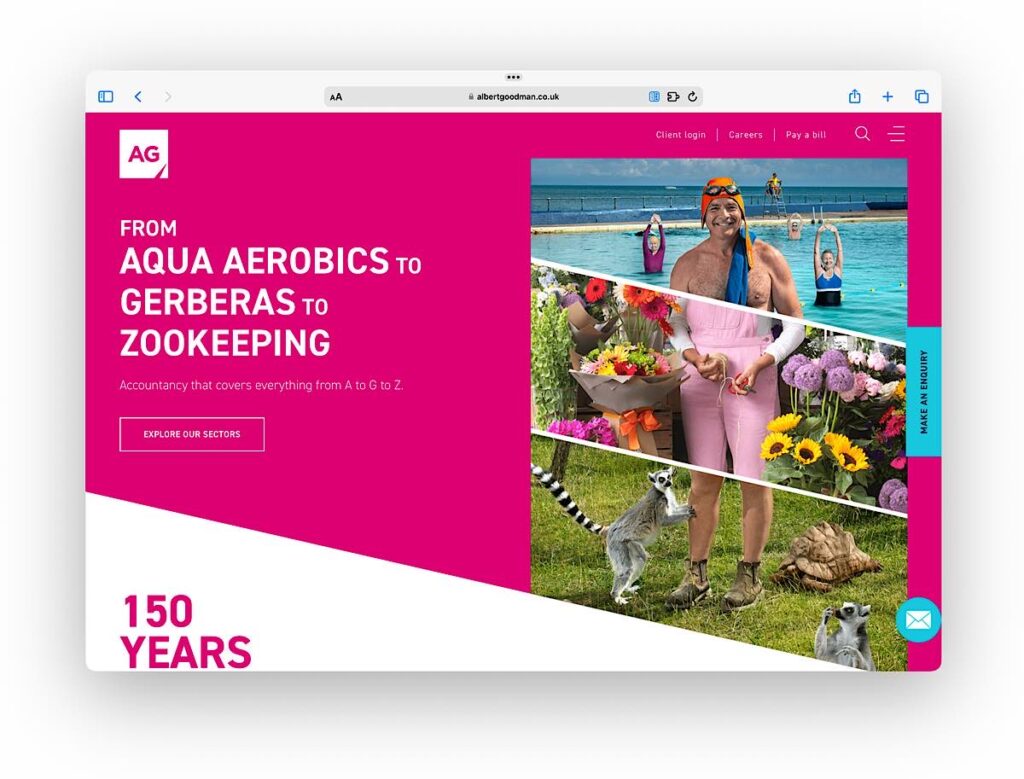

Albert Goodman Chartered Accountants

- Accountancy firm with several branches in the south west of England, including Bristol

- Has a dedicated payroll services department

- Payroll processing

- Tax calculations, sick pay, maternity pay

- HMRC returns

- Pension deductions and reports, child support agency deductions

- End-of-year returns

- Salary payments via epayslips and BACS

- Advice on the best payroll software

- Navigating employment and tax law changes and preparing associated communications

Prices:

- Prices not listed by vendor

- Aimed at enterprise and larger SME so expect fees to reflect this

- Payroll priced on a per-payslip basis but with minimum monthly fee

Website:

Email address:

Phone number:

0117 962 3100

- Takes 2 minutes

- Receive quotes to compare

- Easy and no commitment

Address:

5th Floor

25 King St

Bristol

BS1 4PB

Reviews:

- Google: 5 out of 5 based on 10 reviews

- Trustpilot: 3.2 out of 5 based on 1 review

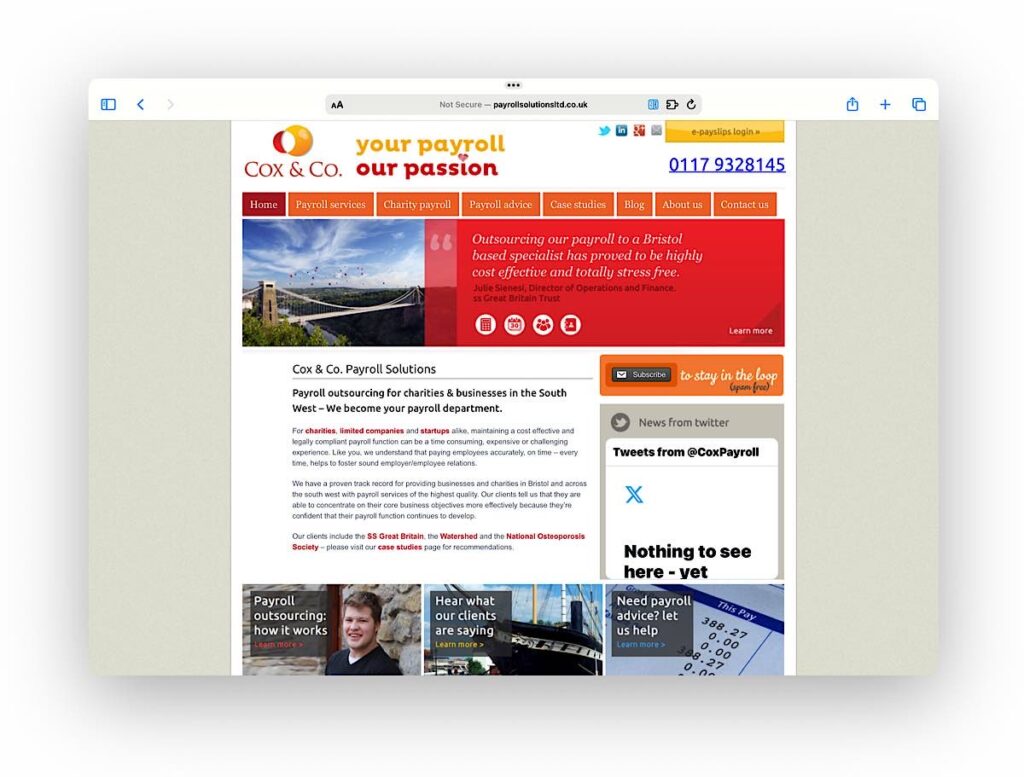

Cox & Co Payroll Solutions Ltd

- Auto enrolment consultation and services

- Initial consultation, transition and setup of your payroll service

- Maintenance, setup and removal of employees throughout the payroll year

- Formatted printed payslips and/or employee self service online

- ePayslips

- Customised reports

- Client Year End Pack

- Handling all HMRC requirements

- PAYE remittance for each relevant tax period

- Logging of new starters and leavers by way of P45 or P46 forms

- Changes to tax rates, bands and codes

- Changes to NI rates and bands

- Online filing of Year End returns

- P35 and P14 forms

- P60 forms for all current employees provided at year end

- Calculations and monitoring of statutory payments and deductions

- SSP, SMP and SPP

- Student Loans

- Attachment of earnings orders

- Payments to CSA

- Contributions to personal or company pension schemes

- Cycle to work schemes

- Calculation of holiday entitlement

- Childcare Vouchers and Payroll giving

- Access to expert information and advice

Prices:

- Starting at £4.00 + VAT per payslip per month

- Minimum monthly fee applies so small payrolls will cost more per employee

Website:

http://www.payrollsolutionsltd.co.uk

Email address:

enquiries@payrollsolutionsltd.co.uk

Phone number:

0117 932 3444

- Give your requirements

- Receive quotes to compare

- Choose a provider or walk away - your choice!

Address:

Unit 10

Londonderry Farm

Willsbridge

Bristol

BS30 6EL

Reviews:

- Google: 4.4 out of 5 based on 7 reviews

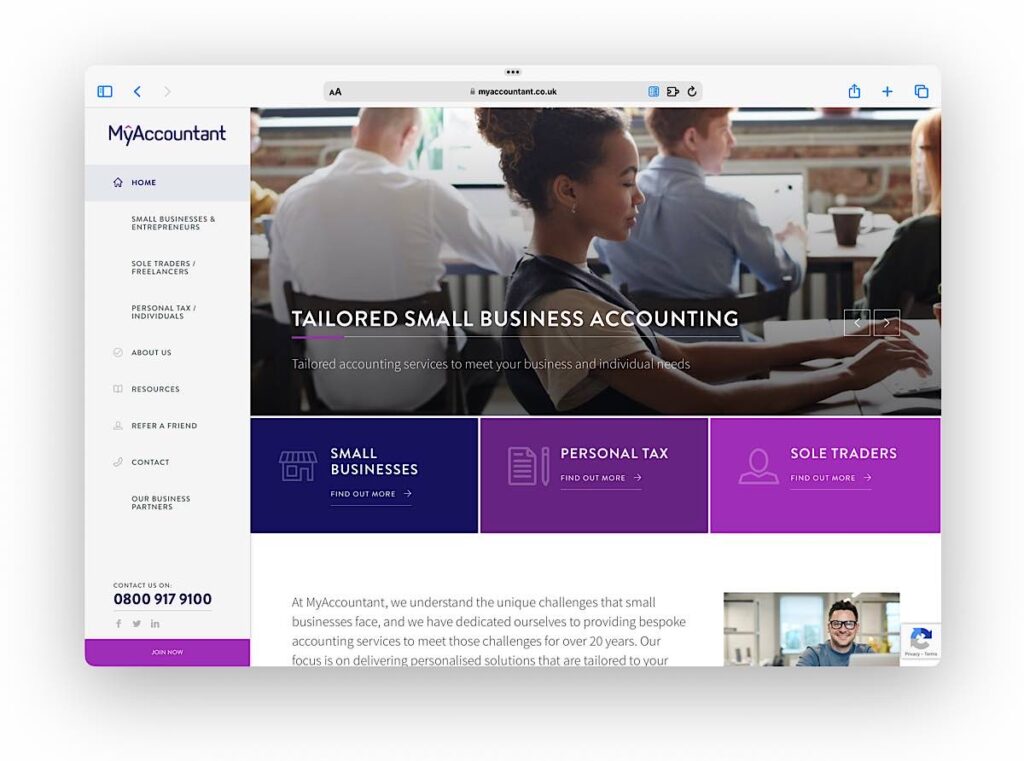

MyAccountant.co.uk Ltd

- One-to-one personal and business consultation

- Year-end accounts & corporation tax

- VAT advice, registration and quarterly vat returns

- Quarterly management accounts

- Monthly payroll submissions (RTI)

- Personal & business tax advice

- Company secretarial and registered office address

- Correspondence with HMRC and Companies House

- Backdated accounting work

- Personal tax returns and advanced tax guidance

Prices:

- Tailored accounting services from only £75 + VAT per month

- Monthly payroll submissions (RTI) from £10 + VAT per month, including all payroll forms (P60, P45) & monthly RTI submissions to HMRC

- VAT registration, quarterly returns preparation and submission from £35 + VAT per month

Website:

https://www.myaccountant.co.uk

Email address:

Phone number:

0800 917 9100

Address:

Whitefriars

Lewins Mead

Bristol

BS1 2NT

Reviews:

- Google: 5 out of 5 based on 11 reviews

- TrustPilot: 4 out of 5 based on 3 reviews

Octane Accountants Limited

- RTI submissions that coordinate with HMRC

- Weekly, monthly and quarterly online payslips

- CIS reporting for construction businesses

- Wider accountancy and business support services also available

Prices:

- Prices not listed by vendor

- Offers a free-of-charge consultation

- Payroll on a per-payslip cost basis with a minimum monthly fee

Website:

https://www.octaneaccountants.co.uk

Email address:

Phone number:

0117 990 2338

Address:

Castlemead

Lower Castle Street

Bristol

BS1 3AG

Reviews:

Park Street Accountants Ltd

- Packaged services that include payroll and other accountancy

- Year end statutory requirements

- Monthly support with bookkeeping and payroll

- Regular meetings

- Information to help grow your business

Prices:

- Packages from £125 per month

- For small businesses to cover all necessary accounting services. Providing monthly bookkeeping and payroll, quarterly VAT returns and year end accounts and tax returns.

Website:

https://www.ps-accountants.co.uk

Email address:

Phone number:

0117 325 9090

Address:

10 Park St

Bristol

BS1 5HX

Reviews:

Stone & Co Chartered Accountants

- Payroll processing

- Management accounts and information

- Bookkeeping

- Business planning and forecasts

- Liaising with banks and institutions

- Annual accounts

- Company secretarial services

- Payroll procedures including Real Time Information and Pensions Auto Enrolment compliance

- Tax returns

- Grant claims

Prices:

- From £85 + VAT per hour for accountancy services

- From £8 + VAT per payslip with a minimum monthly fee for payroll runs

Website:

Email address:

Phone number:

0117 305 2600

Address:

2 Charnwood House

Marsh Road

Ashton

Bristol

BS3 2NA

Reviews:

Total Books Bristol

- Focus on medical professionals, landlords, sub-contractors and freelancers

- Monthly payroll processing

- Business planning

- Management accounts

- Software advice

- Auto enrolment

- Sales, marketing and HR advice

- Pensions

- Company secretarial servicing

- Tax planning

- HMRC compliance and administration

Prices:

- Prices not listed by vendor

- Bespoke pricing on a case-by-case basis

- Free quotes offered

Website:

Email address:

Phone number:

0117 941 5837

Address:

Easton Business Centre

Felix Road, Easton

Bristol

BS5 0HE

Reviews:

Whitestone Accounting Ltd

- Payroll as well as other accounting services

- Annual accounts

- Corporation tax

- Individual tax

- Bookkeeping

- VAT

- Management accounts

- Accountants are CIMA and ATT tax-qualified

Prices:

- From £90 + VAT per hour for accountancy services

- Payroll costs on a per-payslip basis but with a minimum monthly fee

Website:

https://www.whitestoneaccounting.co.uk

Email address:

info@whitestoneaccounting.co.uk

Phone number:

0117 214 0407

Address:

Cavendish House

15 Whiteladies Road

Clifton

Bristol

BS8 1PB

Reviews:

- Google: 5 out of 5 based on 26 reviews

How we determined our rankings – Evaluation criteria

Our selection of Bristol’s best payroll service providers is based on an evaluation of key factors important to delivering outstanding payroll services. Below are the criteria we used to assess each provider:

- Local reputation based on online reviews: We examined online reviews and client testimonials specifically from Bristol-based businesses to understand the performance and reliability of local payroll providers. High marks for accuracy, client service, and problem resolution were important factors in our evaluation.

- Professional accreditation: Acknowledging the importance of professional standards, we valued providers that are accredited by reputable organisations, such as the Chartered Institute of Payroll Professionals (CIPP). Such accreditations signify adherence to high industry standards and a dedication to continual professional development.

- Pricing: Cost efficiency is critical. We scrutinised each provider’s pricing framework, focusing on those that offer transparency and competitive rates without concealed fees, to ensure Bristol businesses can plan their payroll expenses effectively.

- Suitability of payroll management services: The suitability of each provider’s services for Bristol’s diverse business ecosystem was critically assessed. We focused on their capacity to manage everything from local taxation and pension contributions to comprehensive employee benefits, making sure they can support both burgeoning start-ups and well-established enterprises.

FAQ – Payroll services companies in Bristol

Payroll companies in Bristol provide a comprehensive suite of services designed to streamline payroll management for businesses of all sizes. These services typically include calculating employee pay and deductions, managing tax and National Insurance contributions, handling pension contributions and auto-enrolment, issuing payslips, and submitting Real Time Information (RTI) reports to HMRC. Many providers also offer additional support, such as dealing with statutory payments (sick pay, maternity pay), end-of-year tax documents, and tailored reporting to suit specific business needs. Advanced offerings may include integrated HR services, bespoke payroll analysis, and consultancy for complex payroll issues.

Choosing the right payroll service in Bristol involves evaluating several critical factors tailored to your business needs:

Experience and Expertise: Look for providers with a strong track record in your industry or with businesses of a similar size.

Compliance and Accuracy: Ensure the provider stays updated on UK payroll legislation and can guarantee accuracy in their payroll processing.

Scalability: The service should be able to adapt and grow alongside your business.

Integration Capabilities: Consider whether the provider’s software can integrate with your existing HR and financial systems.

Security Measures: Evaluate their data protection and privacy measures to ensure the security of sensitive payroll information.

Customer Support: Check the availability and quality of customer support, including access to payroll experts.

Cost-Effectiveness: Compare pricing structures to ensure you receive value for money.

Recommendations from other businesses and online reviews can also provide insights into the reliability and performance of potential providers.

Yes, payroll services can be highly cost-effective for small businesses in Bristol. By outsourcing payroll, small businesses can save on the costs associated with in-house payroll processing, such as purchasing and maintaining payroll software, training staff, and managing compliance with complex payroll regulations. Additionally, outsourcing helps avoid potential fines associated with payroll errors or non-compliance. Payroll providers offer scalable solutions that can be tailored to the specific needs of small businesses, ensuring that they only pay for the services they require.

Outsourcing payroll offers numerous benefits for Bristol-based companies:

Expertise and Compliance: Access to payroll experts ensures accuracy, compliance with the latest regulations, and up-to-date advice on payroll matters.

Efficiency: Saves significant time and effort that can be redirected towards strategic business activities.

Cost Savings: Reduces the need for in-house payroll software, hardware, and training expenses.

Risk Mitigation: Minimises the risk of errors, penalties, and data breaches through professional management of payroll processes.

Flexibility and Scalability: Services can be tailored to current needs and easily adjusted as the business grows or requirements change.