If you’re seeking a payroll outsourcing bureau for your Brighton & Hove-based business, then this article should have what you need. Here we review the top 8 payroll companies in Brighton & Hove, giving you the key facts to help you choose a local outsourced payroll provider for your business.

Best payroll services companies in Brighton & Hove

- Atkinsons chartered accountants

- Hourly Bookkeeping Brighton

- Nannytax

- PIE Accountancy

- Plus Accounting

- Quantum Bookkeeping

- Stafftax

- West & Berry

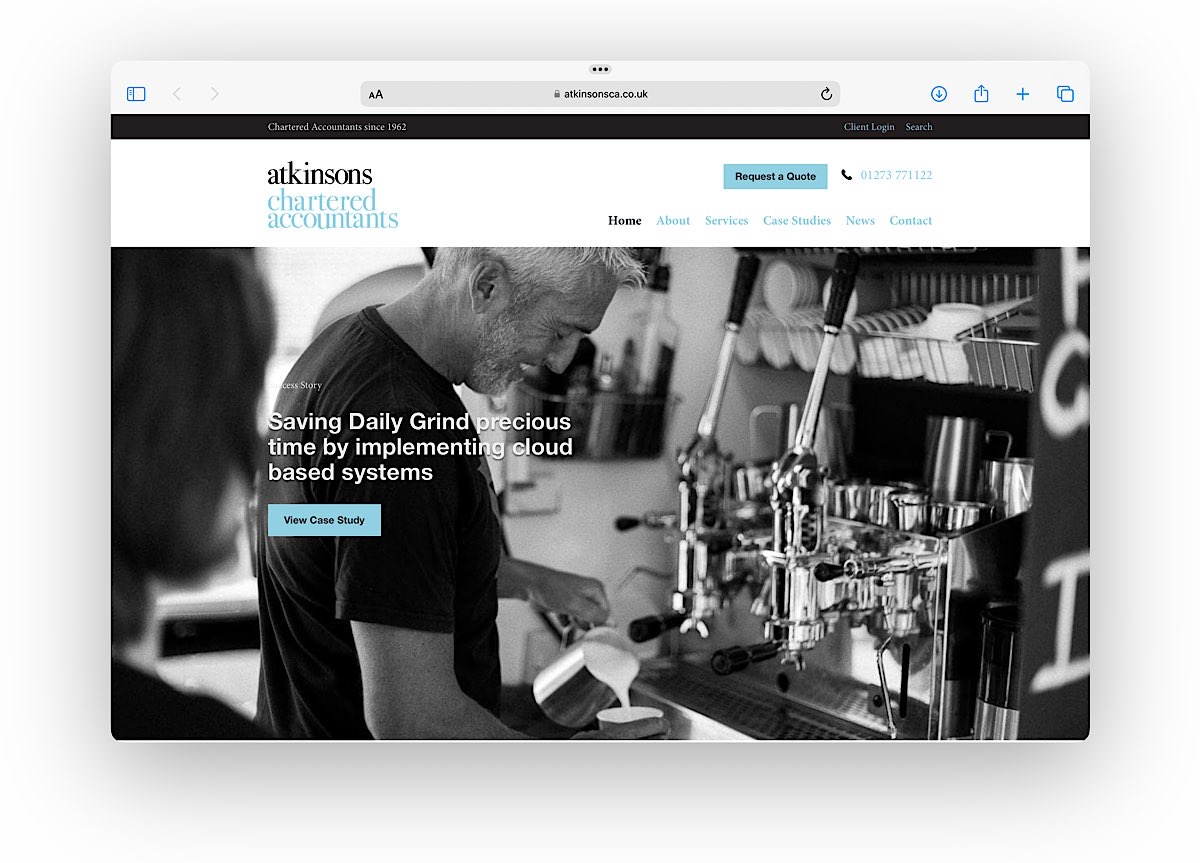

Atkinsons chartered accountants

- Accountants that offer a tailored payroll service

- Services available on a monthly or weekly basis

- Electronic payslips sent directly to all employees

- Help with PAYE

- New starter onboarding

- Support with documentation for those leaving

- P11D form

Prices:

- Prices not listed by vendor

- Get a quote via website form

Website:

Email address:

Phone number:

01273 771122

- Takes 2 minutes

- Receive quotes to compare

- Easy and no commitment

Address:

Palmeira Avenue Mansions

19 Church Rd

Hove

BN3 2FA

Reviews:

- Trustpilot: 2.9 out of 5 based on 2 reviews

- Google: 4.9 out of 5 based on 44 reviews

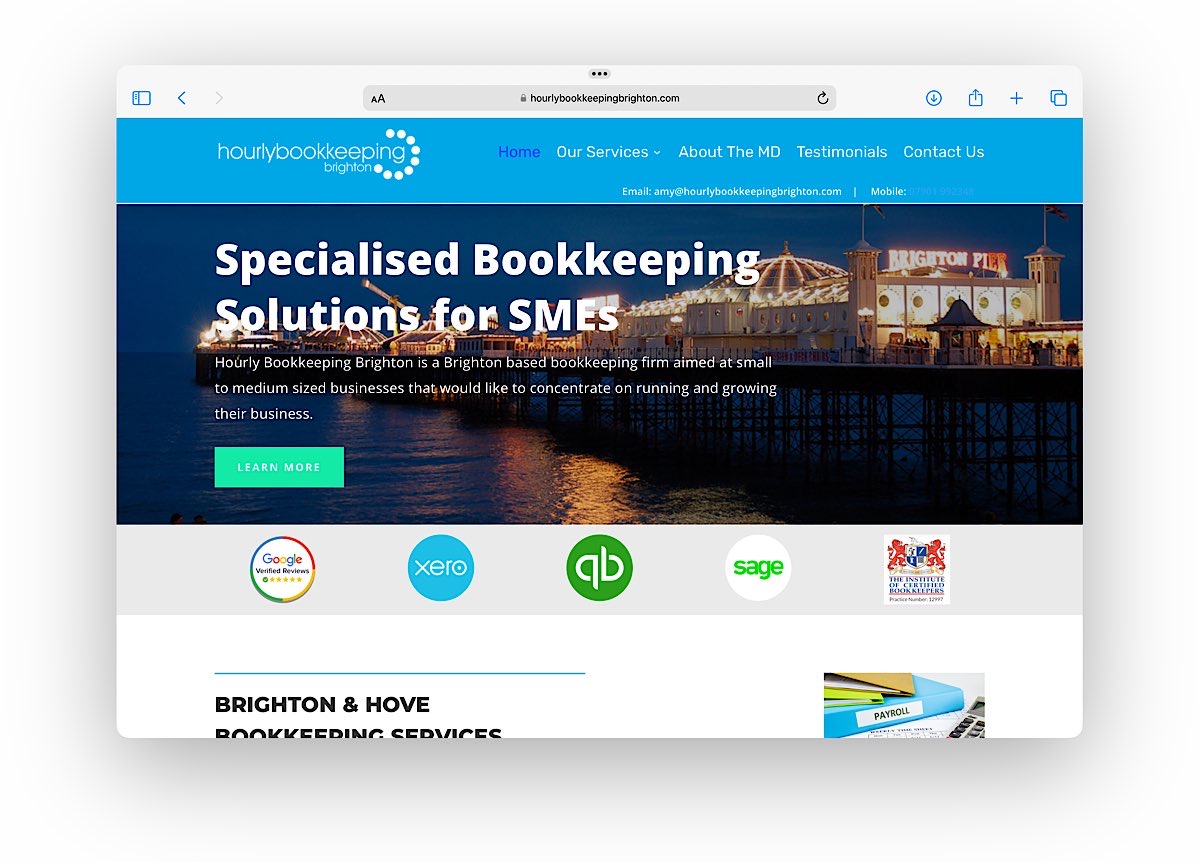

Hourly Bookkeeping Brighton

- Caters from small to medium sized businesses

- Flexible service allowing customers to concentrate on the running of their business

- Monthly / weekly / fortnightly payroll processing service

- Payroll preparation: including payslips and payroll reports

- RTI (real time information) submission to HMRC

- Help manage pension administration

Prices:

- Prices not listed by vendor

- Costed on a per-payslip basis with a minimum change for small payrolls

Website:

https://hourlybookkeepingbrighton.com

Email address:

amy@hourlybookkeepingbrighton.com

Phone number:

07901992348

- Give your requirements

- Receive quotes to compare

- Choose a provider or walk away - your choice!

Address:

Curtis House

34 Third Ave

Brighton and Hove

BN3 2PD

Reviews:

- Google: 5 out of 5 based on 7 reviews

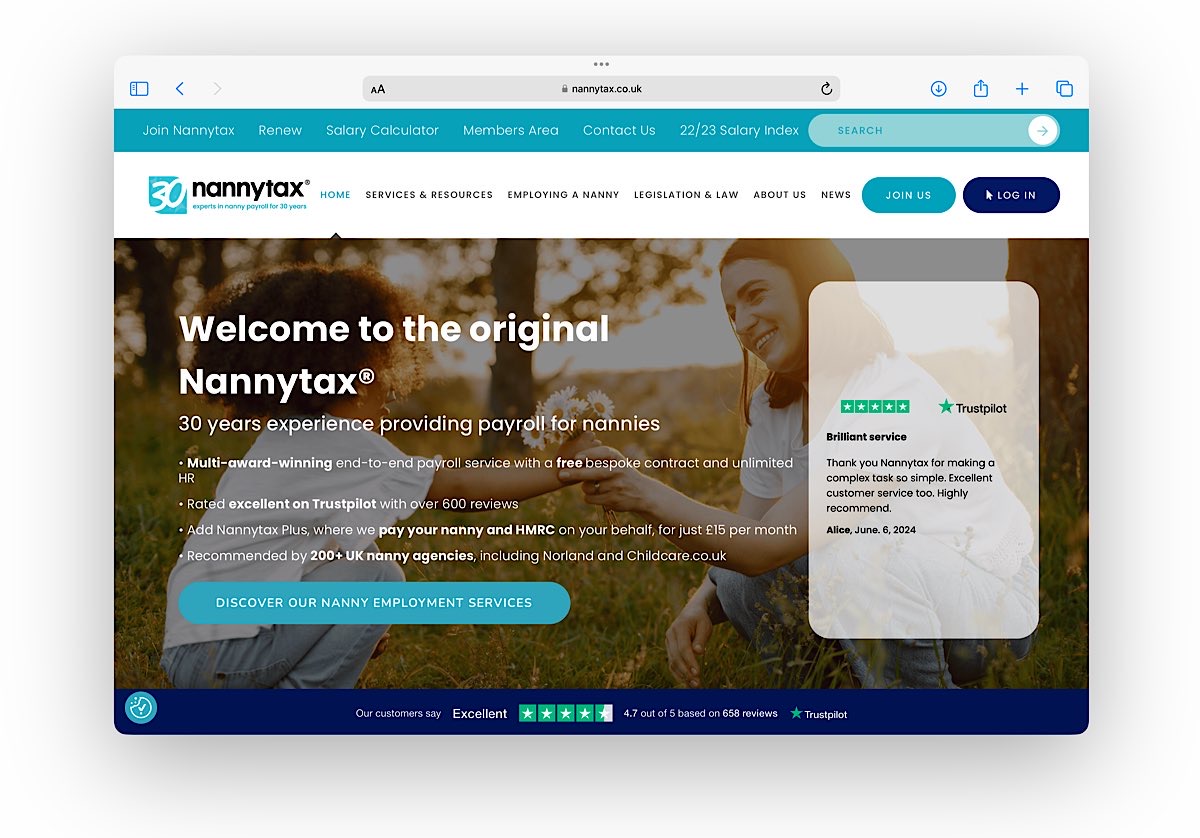

Nannytax

- Caters to nanny employment services

- Multi-award-winning end-to-end payroll service

- Free bespoke contract and unlimited HR

- Tailored contract created by specialist HR advisors

- HR helpline available at anytime with no additional fee

- Option to update service to Nannytax Plus so they pay your nanny and HMRC on your behalf

- Online members area to help manage everything in one place whilst also keeping a record of payslips, P60 and relevant documents

- Nannytax teamed up with Emergency childcare allowing for discounted rates for Nannytax members

Prices:

- £276 per annum for payroll and HR

- Add Nannytax Plus for an extra £15 per month

Website:

Email address:

Phone number:

0203 137 4401

Address:

7th Floor

Telecom House

125-135 Preston Rd

Brighton and Hove

Brighton

BN1 6AF

Reviews:

- Trustpilot: 4.7 out of 5 based on 658 reviews

- Google: 4.1 out of 5 based on 75 reviews

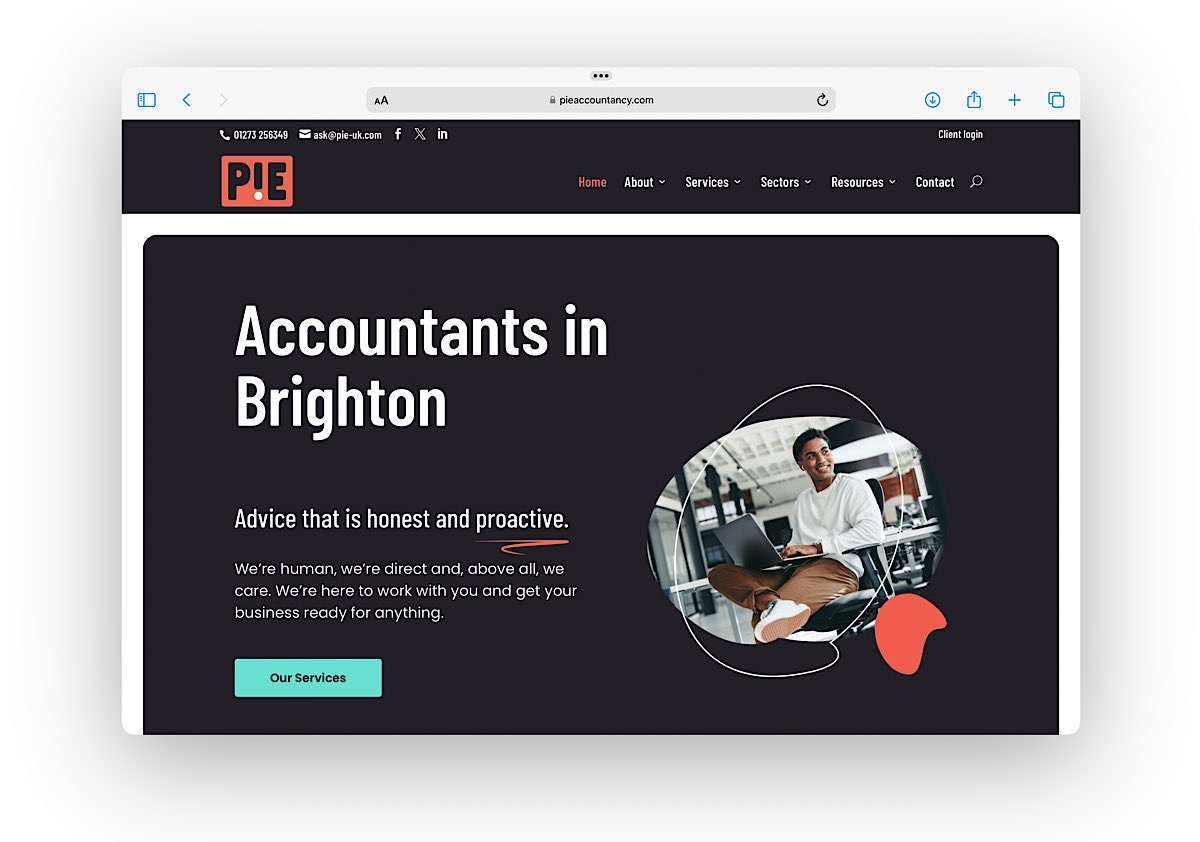

PIE Accountancy

- Automatic payroll processing – flexible payment options such as paychecks or direct deposits

- Tax withholding and wage garnishment – ensure all the right taxes, garnishments and other payroll deductions are held back from the wage before they’re paid out to the employee

- Tax filing services – fill in all taxes on clients behalf and offer year end reporting

- Compliance expertise – keep clients upto date with regulatory requirements

- Payroll reporting – detailed reports of payroll operations

- Handle workplace pension requirements

- Always available for support

Prices:

- Prices not listed by vendor

- Payroll priced on a per-payslip basis

- Accountancy services charged at an hourly rate

Website:

https://www.pieaccountancy.com

Email address:

Phone number:

01273 256 349

Address:

First floor office

5 Bartholomews

Brighton and Hove

Brighton

BN1 1HG

Reviews:

- Google: 5 out of 5 based on 50 reviews

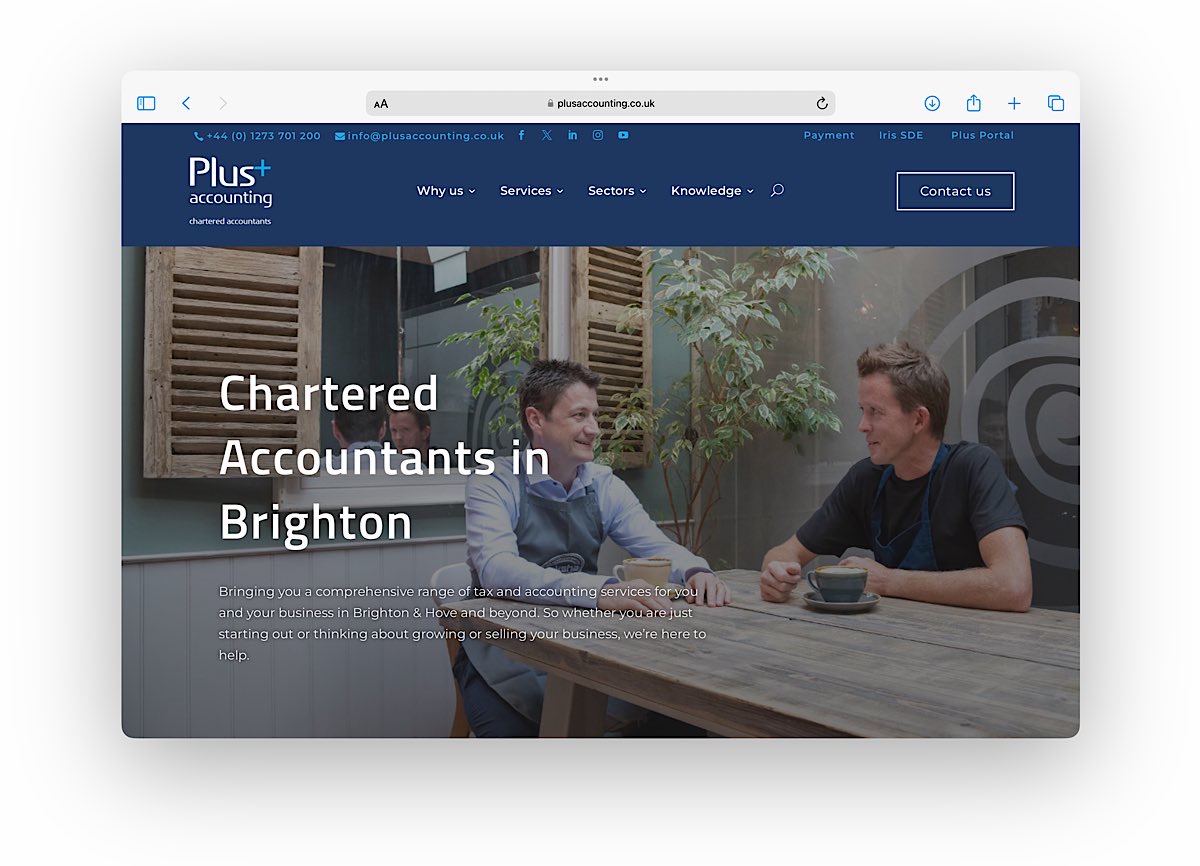

Plus Accounting

- Accountants that outsource their payroll to Sussex payroll service

- Through partnership with Sussex payroll services they provide:

- Customised payslips

- Administration of PAYE, National Insurance, Statutory Sick Pay, Statutory Maternity Pay etc

- Completion of statutory year end returns for your employees and HMRC

- Summaries and analysis of staff costs

- Administration of incentive schemes, bonuses, termination payments and ex-gratia payments

- Administration of pension schemes, including auto enrolment pensions

Prices:

- £216 per annum for payroll

- Additional payroll set up cost for business with over 10 employees

Website:

https://www.plusaccounting.co.uk

Email address:

Phone number:

01273 701 200

Address:

Preston Park House

South Rd Preston

Brighton and Hove

Brighton

BN1 6SB

Reviews:

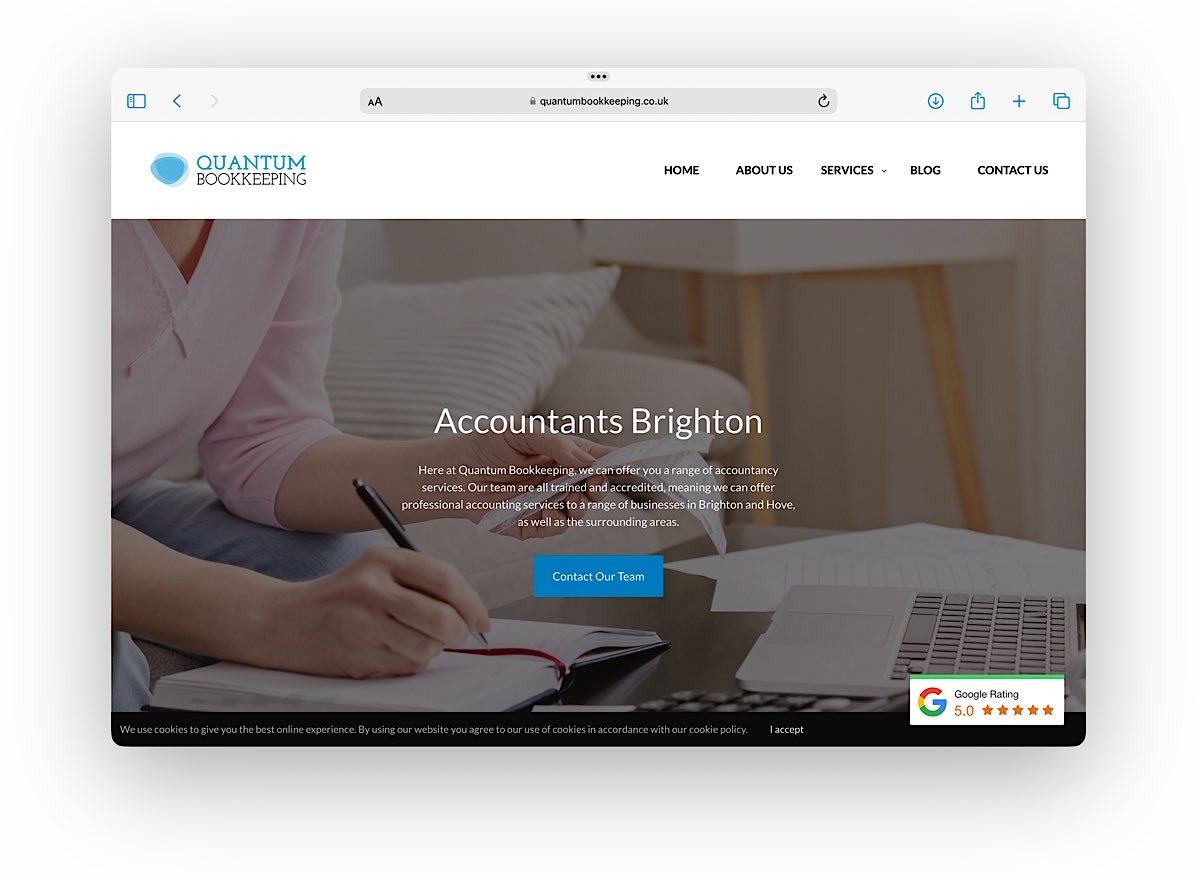

Quantum Bookkeeping

- Bookkeeping company that offers a payroll service

- They will track hours employee has worked

- Calculate payslips and send employees their pay

- Have a team of AAT qualified and experienced bookkeepers and accountants

- Offer a friendly approachable service, take the time to get to know customer and their business, allowing them to reduce the administrative burden on their clients

- Main goal is to offer their clients solutions to their financial and business needs

Prices:

- Offer a free initial consultation to businesses and start-ups

Website:

https://www.quantumbookkeeping.co.uk

Email address:

hello@quantumbookkeeping.co.uk

Phone number:

01273 044 178

Address:

137 The Gardens

Southwick

Brighton

BN42 4AR

Reviews:

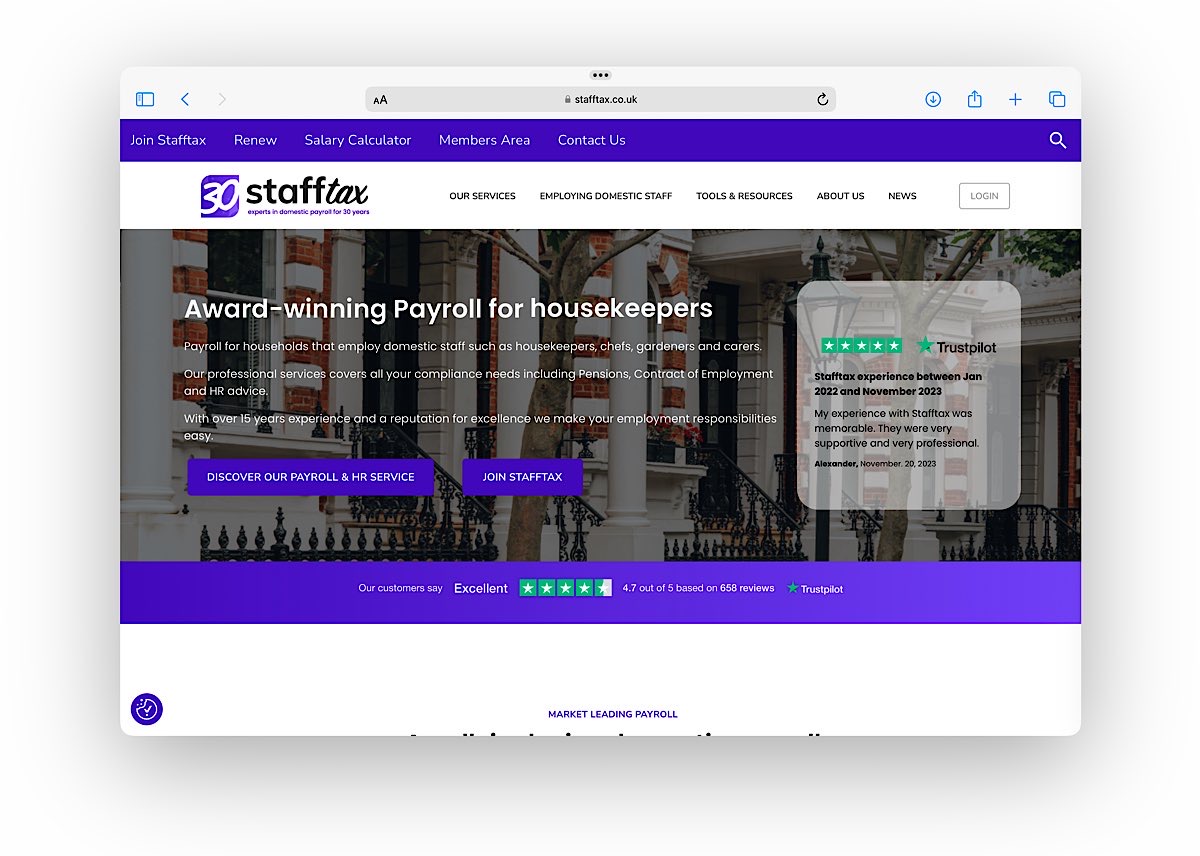

Stafftax

- Payroll for households that employ domestic staff such as housekeepers, chefs, gardeners and carers

- Service that covers compliance needs such as pensions, Contract of employment and HR advice

- Provide a tailored contract

- Enure all legal obligations as an employer are covered

- Deal with HMRC

- Unlimited HR support helpline, free once subscribed

Prices:

- £276 per annum for payroll and HR

- Add Stafftax Plus for an extra £15 per month

Website:

Email address:

Phone number:

0203 137 4407

Address:

7th Floor

Telecom House

125-135 Preston Rd

Brighton and Hove

Brighton

BN1 6AF

Reviews:

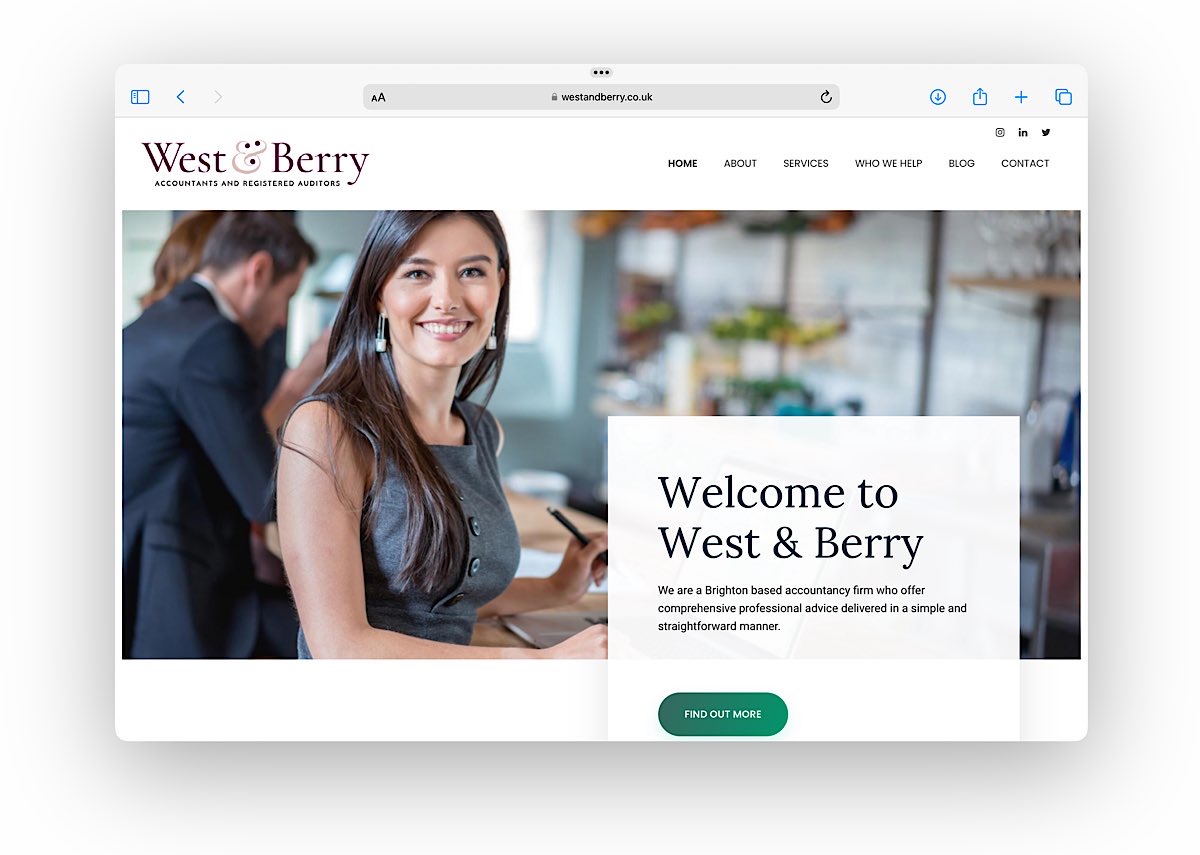

West & Berry

- Accountants that offer a payroll service

- Team made up of chartered certified accountants and registered auditors

- Offer fully comprehensive service with payroll training

- They can support small or much larger businesses, individuals and charities

- Support all aspects of payroll including RTI and auto enrolment pensions

- Also offer bookkeeping

Prices:

- Initial consultation is free

- Bookkeeping and accountancy services charged at an hourly rate

- Payroll charged using a per-payslip model with minimum monthly fee

Website:

https://www.westandberry.co.uk

Email address:

Phone number:

07702662743

Address:

Nile House

Nile Street

Brighton

BN1 1HW

Reviews:

How we determined our rankings – Evaluation criteria

In our quest to identify the top payroll service providers in Brighton & Hove, we utilised a thorough evaluation process based on several important factors. Here’s how we assessed each provider:

- Local Reputation Based on Online Reviews: We delved deeply into online reviews and customer feedback specifically from businesses located in Brighton & Hove. Providers that consistently showed high levels of customer satisfaction, payroll accuracy, and excellent support services were ranked higher.

- Professional Accreditation: Professional accreditations are crucial indicators of a provider’s commitment to quality and adherence to industry standards. We gave priority to providers accredited by reputable organisations such as the Chartered Institute of Payroll Professionals (CIPP), highlighting their reliability and expertise.

- Pricing: Clear and fair pricing is essential. We evaluated the pricing structures of each provider, prioritising those that offer straightforward, competitive rates with no hidden fees. This ensures that businesses in Brighton & Hove can effectively budget their payroll expenses.

- Suitability of Payroll Management Services: We assessed the adaptability and comprehensiveness of the payroll services offered, focusing on their ability to meet the specific requirements of Brighton & Hove’s diverse business community. This evaluation included the efficiency of managing statutory requirements like tax obligations, pension schemes, and employee benefits, catering to both smaller businesses and larger corporations.

FAQ – Payroll services companies in Brighton & Hove

To assess the scalability of a payroll provider in Brighton & Hove, consider the following:

Flexibility in Services: Determine if the provider offers different service levels and can easily adjust to increased demands or changes in your workforce size.

Technology Infrastructure: Check if their technology and systems can handle growth without degradation in performance or service quality.

Client Testimonials: Look for feedback from current clients, particularly those who have experienced significant growth or changes while using the provider’s services.

Consultation Response: During initial consultations, discuss your growth projections and specific needs to see how they propose to support your business as it evolves.

Indicators of a robust security framework in payroll providers include:

Data Encryption: Ensure that the provider uses strong encryption for data at rest and in transit.

Regular Security Audits: Check if the provider conducts regular security audits and has certifications like ISO/IEC 27001.

Access Controls: Determine if they have stringent access controls and authentication methods to protect sensitive data.

Compliance with Legislation: Verify their compliance with data protection laws such as GDPR, which is crucial for protecting employee information.

To choose a payroll provider that aligns with your business values in Brighton & Hove:

Corporate Responsibility: Look into their corporate social responsibility initiatives to see if they match your business’s ethos.

Transparency and Ethics: Evaluate their transparency in pricing, customer service, and handling of payroll data.

Environmental Policies: Consider their commitment to sustainability and whether they have any green policies in place.

Community Engagement: Check their involvement in local community projects or charities, which can reflect a commitment to social values.

From a payroll provider in Brighton & Hove, you can expect the following customisation options:

Tailored Reporting: Ability to customise reports to fit your specific business analysis needs.

Flexible Payment Schedules: Options to set up multiple payment schedules or tailor payment methods according to employee preferences.

Benefit Management: Customisation of benefit management, including pensions, healthcare, and other employee perks.

Adaptable Service Packages: Services that can be tailored to include or exclude certain features based on your business size and complexity.

To ensure a payroll provider in Brighton & Hove stays current with evolving payroll legislation, you should:

Ask About Recent Changes: Inquire how they have implemented recent legislative changes into their service.

Professional Development: Check if their team undergoes regular training and professional development to stay up-to-date with payroll laws.

Membership in Professional Bodies: Confirm if they are members of professional organizations such as the Chartered Institute of Payroll Professionals (CIPP), which often provide updates and training on legislative changes.

Feedback Loop: Look for a provider that offers regular updates and briefings to clients about changes in payroll legislation and how these affect their services.