Payroll numbers, an integral part of the employment landscape, serve as a unique identifier for employees within a company’s payroll system. This article aims to demystify your payroll number for UK businesses, explaining their purpose, where to find them, and addressing frequently asked questions.

What are payroll numbers?

A payroll number is a unique code assigned to employees when they join a company. This identifier is crucial for payroll processing, allowing employers to efficiently manage salaries, taxes, and pension contributions. It ensures that the financial transactions related to an employee’s remuneration are accurately recorded and processed.

Where to find payroll numbers

Payroll numbers are typically generated and managed by an organisation’s human resources (HR) or payroll department. Upon joining a company, an employee is assigned a payroll number, which can usually be found on:

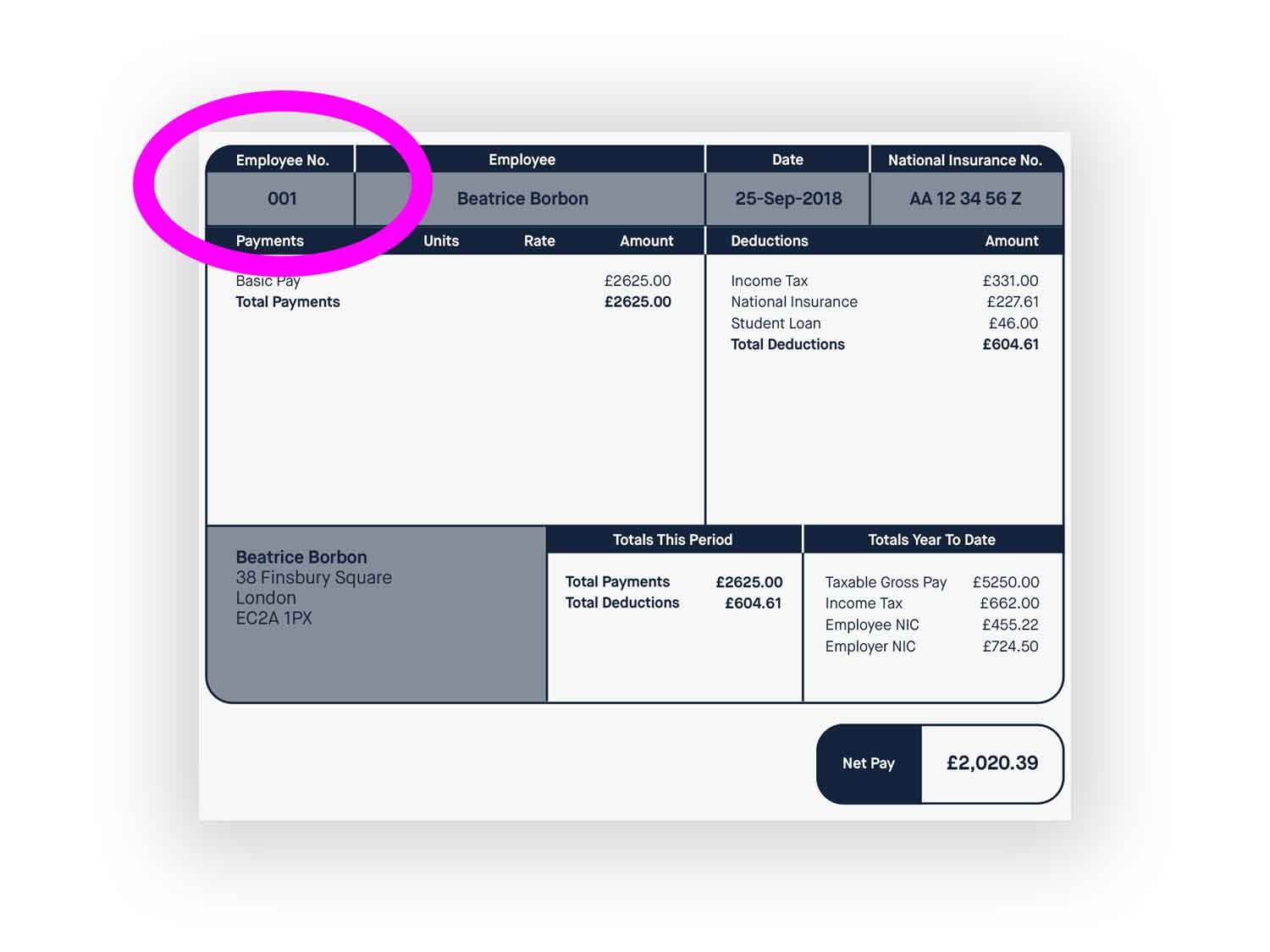

- Pay slips: The most common place to find an employee’s payroll number is on their monthly or weekly pay slip.

- P60 forms: Issued at the end of each tax year, the P60 form summarises an employee’s total pay and deductions for the year. The employee’s number is displayed prominently.

- P45 forms: When an employee leaves a job, they receive a P45 form detailing their salary and the taxes paid during the employment period. The employee’s number is included on this form.

- HR or payroll portals: Many companies provide online portals or payroll software where employees can access their payroll information, including their payroll number.

Payroll numbers FAQ

The payroll number is crucial for a multitude of reasons. It simplifies the management of payroll records, ensuring that payments and deductions are accurately associated with the correct employee. It also facilitates the swift resolution of any payroll-related queries or issues.

- Takes 2 minutes

- Receive quotes to compare

- Easy and no commitment

No, the payroll number and national insurance (NI) number serve different purposes. While the payroll number is a unique identifier within a company’s payroll system, the NI number is a unique identifier assigned by the government to track an individual’s social security contributions and benefits.

The method of generating a payroll number varies from company to company. Some organisations may use a sequential numbering system, while others might use a combination of letters and numbers based on department, employment date, or other criteria. The key is that each payroll number must be unique to avoid confusion or errors in processing salaries.

If you lose or forget your payroll number, you should contact your company’s HR or payroll department. They will be able to provide you with your number after verifying your identity to ensure confidentiality and security.

Typically, an employee’s payroll number remains the same throughout their employment with a company. However, in certain circumstances, such as a company reorganisation or a change in payroll systems, payroll numbers might be reassigned or altered. Employees should be notified of any such changes.

- Give your requirements

- Receive quotes to compare

- Choose a provider or walk away - your choice!

While the number itself is not sensitive information, it is associated with confidential payroll and personal data. Therefore, it’s important to handle payroll numbers with a degree of confidentiality to prevent misuse or unauthorised access to employee information.

Payroll numbers play a vital role in tax documentation by linking employees’ income and tax details to their employer’s records. This ensures that the correct amount of tax is deducted under the Pay As You Earn (PAYE) system and helps the HM Revenue and Customs (HMRC) to accurately record an individual’s tax payments and entitlements.

In most cases, an employee will have a single number per employer. However, if an individual holds multiple positions within different departments or subsidiaries of a larger organisation that processes payroll separately, they might be assigned a unique number for each role.

Upon leaving a company, your payroll number remains in the organisation’s records as part of your employment history. It is generally not reassigned to another employee. Your number will be used in any final salary payments, your P45 form, and may be referenced in future queries relating to your period of employment.

While there’s no legal requirement dictating the format of payroll numbers, businesses must ensure their payroll practices, including the use and management of payroll numbers, comply with UK employment law. This includes adhering to data protection regulations to safeguard employees’ personal information.

To maintain the security of payroll numbers and associated employee information, businesses typically employ a range of security measures. These can include data encryption, secure payroll systems, restricted access controls, and regular audits. Ensuring compliance with the General Data Protection Regulation (GDPR) is also crucial for protecting personal data.

No, the concept and use of payroll numbers can vary significantly between countries. While the basic principle of a unique employee identifier for payroll purposes is common, the specific implementation, terminology, and legal requirements can differ. For instance, in the United States, Social Security Numbers (SSNs) often serve a somewhat similar purpose but have broader implications and uses.

Changes in personal details, such as a name change due to marriage or divorce, do not usually affect an employee’s payroll number. The number remains a consistent identifier, while the employee’s personal records are updated accordingly. It’s important for employees to inform their employer of any changes to ensure all records, including tax documents, are accurate.

In conclusion, understanding the role and management of payroll numbers is crucial for both employers and employees. They are not just identifiers but key components of an efficient and secure payroll system. Should you have any further questions regarding payroll numbers or payroll management, your HR or payroll department is a valuable resource for information and support.