If you’re seeking a payroll outsourcing bureau for your Leicester-based business, then this article should have what you need. Here we review the top 7 payroll companies in Leicester, giving you the key facts to help you choose a nearby outsourced payroll provider for your business.

Best payroll companies in Leicester

- Beechwood Accountants

- BGS Accounting Limited

- BRS Accounting Services Limited

- Helpatax

- MNE Accounting

- Protective Figures Ltd

- The Zak Partnership Ltd

Beechwood Accountants

- Payroll and auto enrolment pensions

- Business startup support

- Bookkeeping & VAT

- Self assessments

- Company secretarial services

- Annual accounts

- Cloud accounting

Prices:

- Transparent fee structure

- Can charge for late payment of fees

- Fees will be agreed by both parties prior to providing the service

Website:

https://beechwoodaccountants.com

Email address:

Phone number:

0116 220 0112

- Takes 2 minutes

- Receive quotes to compare

- Easy and no commitment

Address:

Ground Floor

Vantage Park

6 High View Cl

Leicester

LE4 9LJ

Reviews:

BGS Accounting Limited

- Payroll management

- Bookkeeping

- Invoicing

- Credit control

- VAT returns

- Cash flow forecasting

- Management accounting

- Process improvements

- Project Management

- Software implementation

- Internal risk assessments

- Finance Director consultancy

Prices:

Pre-configured packages that include payroll services and other accounting and business support services:

Startup package

- Free company formation

- HMRC registration for Corporation Tax

- Year-end financial statements

- Corporation Tax return

- Filing of Confirmation Statement

- Completion of Self-Assessment tax return (up to 1 director)

- Access to your own dedicated accountant for help and advice

- Payroll for 2 people

- Xero Subscription

Pay Monthly – £110*

Pay Annual – £1210*

(Pay annual get one month free)

- Give your requirements

- Receive quotes to compare

- Choose a provider or walk away - your choice!

Standard package

- All of the Starter pack

- HMRC registration for VAT, CIS and PAYE

- Quarterly VAT return review & submissions

- Use of our premises for registered office address

- CIS submissions for sub-contractors (receiving deductions)

- Completion of Self-Assessment tax returns (up to 2 directors)

- Dividend administration

- Payroll for 5 people

- Xero Subscription

Pay Monthly – £160*

Pay Annual – £1760*

(Pay annual get one month free)

Growth package

- All of the Starter and Standard

- Quarterly management reports

- Pension administration

- Monthly CIS Returns for contractors (making deductions)

- Completion of Self-Assessment tax returns (up to 3 directors)

- Filing of Confirmation Statement

- Basic annual tax planning service

- Payroll for 10 people

- Xero Subscription

Pay Monthly – £300*

Pay Annual – £3300*

(Pay annual get one month free)

Established package

- All of the Premium

- Access to your own dedicated accountant for all help and advice

- Payroll processing and P11D filing (up to 15 employees)

- Pension administration

- CIS returns for subcontractors (being deducted) and contractors (making deductions)

- Completion of Self-Assessment tax return (up to 4 directors)

- Monthly management reports tailored to your business

- Guidance and assistance with raising finance

- Regular meetings with your dedicated business advisor

- Comprehensive personal and business tax planning service

- Use of our premises for registered office address

- Standard Xero subscription included

Pay Monthly – £700*

Pay Annual – £7700*

(Pay annual get one month free)

Website:

https://www.bgsaccounting.co.uk

Email address:

Phone number:

07816 130053

07940 780751

Address:

The Dock

75 Exploration Drive

Leicester

LE4 5NU

Reviews:

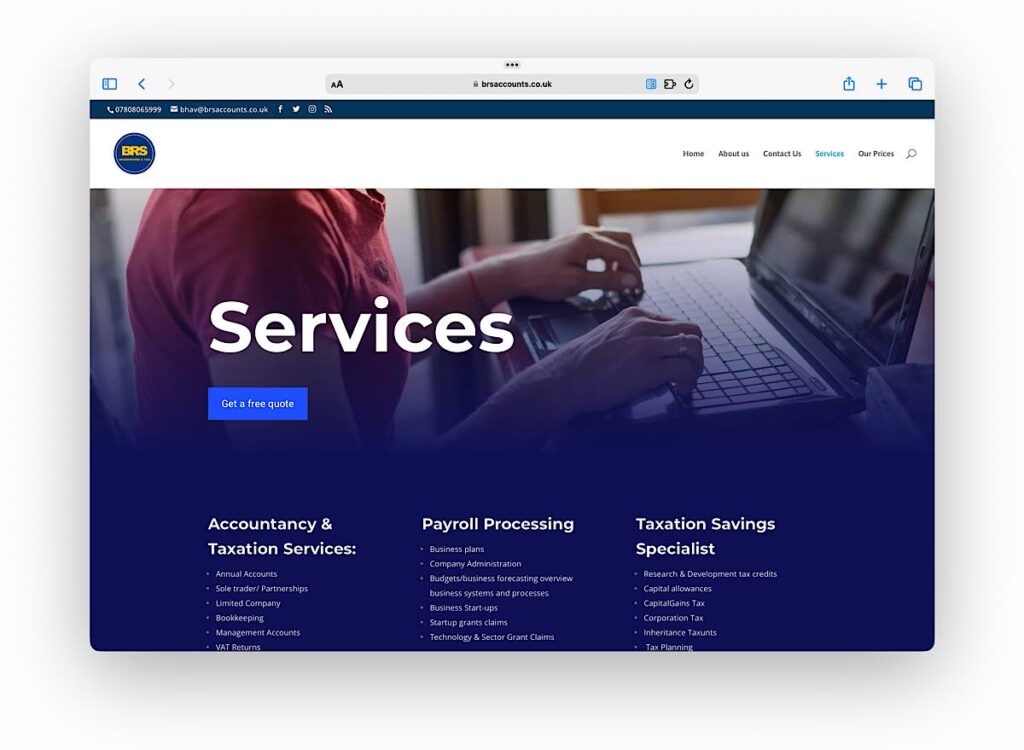

BRS Accounting Services Limited

- All aspects of payroll processing and management

- Annual accounts

- Bookkeeping

- Management Accounts

- VAT Returns

- Tax Returns

- Business plans

- Company Administration

- Budgets and forecasting

- Business start-ups support

- Startup grants claims

- Technology and sector grant claims

- Research & Development tax credits

- Corporation tax

- Tax planning

Prices:

- Monthly payroll up to 5 payslips – £25 per month

- Additional payslips and payroll processing – £10 per employee per month

- Other accounting and business support services from £30 per hour + VAT

Website:

Email address:

Phone number:

07808065999

Address:

6 Woodlands Ct

Oadby

Leicester

LE2 4QE

Reviews:

- Google: 5 out of 5 based on 21 reviews

Helpatax

- Managing whole payroll process

- Assisting with automated payment set-up

- Installing payroll software and training staff

- Employee payslips

- End of year submissions

- Accounting services

- Corporate tax

- VAT

- Self Assessment

- Business planning

- Company secretarial

- HMRC investigations support

Prices:

- Payroll processing from £50 per month

- Accountancy services from £96 + VAT per hour

Website:

Email address:

Phone number:

Address:

108 Belgrave Gate

Leicester

LE1 3GR

Reviews:

- Facebook: 4.8 out of 5 based on 27 reviews

- Google: 5 out of 5 based on 26 reviews

- Yell.com: 5 out of 5 based on 4 reviews

MNE Accounting

- Outsourcing of accountancy and payroll

- Making Tax Digital advice

- Year-end accounts

- Payroll services and support

- Bookkeeping

- VAT returns and advice

- Accounting software setup

- Management accounts

- Tax returns and advice

- Software migration service

- Finance director outsourcing

- Credit control service

Prices:

- Payroll processing on a per-payslip cost basis starting at £50 per month

- Accountancy services from £90 + VAT per hour

Website:

https://www.mneaccounting.co.uk

Email address:

Phone number:

0116 255 2422

Address:

The Phoenix Yard

5-9 Upper Brown Street

Leicester

LE1 5TE

Reviews:

Protective Figures Ltd

- Accountancy firm offering payroll services

- Monthly payroll submissions. Real Time Information (RTI)

- NEST contributions calculations

- NEST auto-enrolment

- NEST opt-out

- Each individual employee payslips

- Employer summary payslip

- End of year submissions

- P45, P60 & P11Ds

Prices:

- Payroll processing from £6 per payslip

- Initial setup fee applies

- Accountancy services from £65 + VAT per hour

Website:

https://www.protectivefigures.co.uk

Email address:

Phone number:

0795 8484 104

Address:

81 London Road

First Floor

Leicester

LE2 0PF

Reviews:

- Google: 5 out of 5 based on 24 reviews

The Zak Partnership Ltd

- Payslips – production and distribution

- Monthly payroll summaries and reports (by department for example)

- Management of new starters and leavers

- Analysis of staff costs

- PAYE returns

- Assistance with automated payment set-up to your employees

- Employer annual return P35

- Employee summary P60s and P14s

- P11D and P9D benefit and expenses returns

Prices:

- Prices not listed by vendor

- Payroll processing on priced on a per-payslip basis with a minimum monthly fee

Website:

Email address:

Website:

0116 2207646

Website:

20 Ashfield Rd

Leicester

LE2 1LA

Reviews:

How we determined our rankings – Evaluation criteria

In our search for Leicester’s best payroll service providers, we conducted an in-depth evaluation based on several key factors. Here’s how we assessed each provider:

- Local reputation based on online reviews: We carefully analysed online reviews and feedback from businesses based in Leicester. Providers that consistently showed high levels of client satisfaction, accuracy in payroll handling, and excellent customer support were ranked highly.

- Professional accreditation: We placed significant emphasis on the professional accreditations held by each provider. Accreditation by respected institutions, such as the Chartered Institute of Payroll Professionals (CIPP), indicates a provider’s commitment to professional excellence and compliance with industry standards.

- Pricing: Transparency in pricing structures was a major criterion. We prioritised providers that offer straightforward, competitive pricing without hidden fees, ensuring that businesses in Leicester can effectively manage their payroll costs and anticipate their financial planning.

- Suitability of payroll management services: The range and suitability of services offered were scrutinised to ensure they meet the diverse needs of Leicester’s business sector. This includes evaluating providers’ capabilities in managing statutory requirements such as tax, pensions, and employee benefits, tailored to support both small local firms and larger corporations.

FAQ – Payroll services companies in Leicester

Payroll companies in Leicester offer a range of services to meet the diverse needs of businesses operating within the city. These services often include the processing of employee wages, calculation and deduction of taxes and National Insurance contributions, management of pension contributions under auto-enrolment regulations, provision of electronic or paper payslips, handling statutory payments like maternity or sick pay, and ensuring compliance with Real Time Information (RTI) submissions to HMRC. Additional services may encompass bespoke payroll reporting, assistance with expatriate payroll, integrated HR management solutions, and advisory services on complex payroll and tax issues.

Choosing the right payroll provider in Leicester involves several important considerations:

Understand Your Needs: Clearly define your payroll requirements, including any unique aspects related to your industry or company size.

Research and Recommendations: Seek providers with a proven track record in handling businesses similar to yours. Recommendations from business associates can be particularly valuable.

Check for Compliance and Accuracy: Ensure that the provider is knowledgeable about current UK payroll legislation and can offer accurate processing.

Assess Technology and Integration: Look for providers whose systems can integrate smoothly with your existing HR and accounting software.

Evaluate Security Protocols: Confirm that the provider uses robust data security measures to protect sensitive payroll information.

Consider Customer Service: The level of support and accessibility to payroll experts is crucial for addressing any issues or questions.

Compare Pricing: Ensure the pricing structure is transparent and provides good value for the services offered.

Arranging meetings or demos with potential providers can also help in making an informed decision.

Yes, small businesses and start-ups in Leicester can greatly benefit from outsourcing their payroll functions. Payroll service providers offer scalable solutions that can be tailored to the specific needs of smaller businesses, allowing them to enjoy compliance, efficiency, and expertise without the overhead of managing payroll in-house. Outsourcing can help small businesses avoid common payroll errors, save time, reduce costs associated with payroll software or dedicated staff, and ensure employees are paid accurately and on time.